Other Exchanges Catching up to Mt. Gox in Bitcoin Trading Volume

It didn't seem like it was terribly long ago that Mt. Gox was leading by miles in terms of being the de facto Bitcoin exchange. Fast forward to early November, and we're finding out that Mt. Gox is not longer, well, leading by miles. In fact, two exchanges are catching up to Gox in trading volume. The first is - and I say this with little to no surprise - BTC China. The Chinese have taken tremendous interest in the digital currency, and as such, BTC China's trading volume is about 571k, compared to Gox's 578. Behind BTC China is BitStamp, with a volume of 547k. There's still a a sizable....

Related News

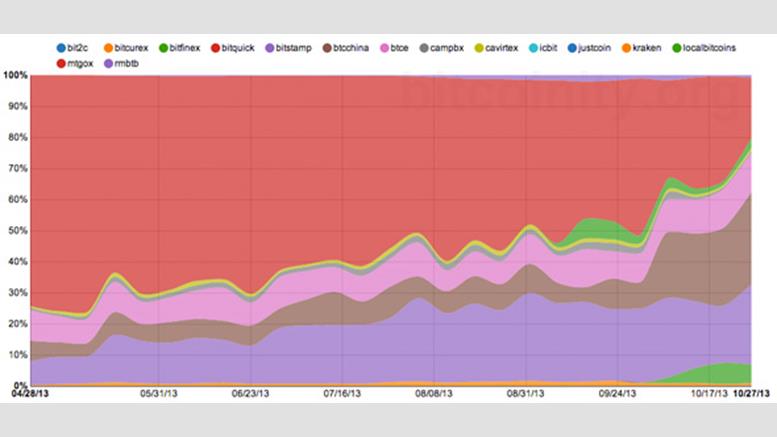

The vast majority of bitcoin trading volume has traditionally been handled by a relatively small number of exchanges. However, the latest data indicates that volume has concentrated even further as smaller exchanges are being pushed aside, leaving them with a much lower share of the total volume of bitcoins traded than just a few months ago. Lost monopoly. Prior to the start of its decline in mid-2013, Mt. Gox had what amounted to an effective monopoly on bitcoin trading volume, often commanding upwards of 80-90% of total US dollar-denominated volume. However, as Mt. Gox's problems....

In the long run, suppressing volatility and speculation will be positive for the bitcoin market. Bitcoin trading volume has been plummeting across all major Chinese exchanges. That is not entirely unexpected, considering these platforms have removed most of their margin trading options. Moreover, trading fees have been reinstated across Chinese exchanges, which will heavily impact trading activities. For the time being, this has not impacted the Bitcoin price all that much, though. The one-hour trading volumes across most major Chinese bitcoin exchanges took a big hit. Earlier tonight,....

Bitcoin trading volume is shifting to new exchanges, data shows. Following the decision by major China-based exchanges to end the practice of no-fee trading (at the request of the country's central bank), their lesser-known competitors have begun to claim the top spots in terms of transaction activity. In the aftermath of the big exchanges adding trading fees – BTC100 and CHBTC – two China-based marketplaces, have climbed to the number one and number two spots in trading volume, according to CoinMarketCap figures and the companies' websites. BTC100, which came out on top, enjoyed more than....

Last week's bitcoin price surge, initiated a chain react across all major bitcoin exchanges and bitcoin's trading volume reached its highest point in since late 2014. So, so did the price surge enkindle the rise in the trading volume? or did it go the other way round; the boosted trading volume pushed bitcoin price "to the moon"? Bitcoin Trading Volume Rising Across All Major Exchanges: According to blockchain.info, the bitcoin/USD exchange volume reached $42,637,208 on the 5th of November, the day that witnessed a price high of $447.47 on Bitstamp. Although the price exceeded $500 on the....

The recent levelling out of bitcoin's price volatility might be good news for everyday bitcoin users, but could it send a bunch of exchanges off the cliff? CoinDesk recently spoke to the CEO of a company whose fortune depends on the health of bitcoin exchanges. In the off-record conversation, the exec had something disturbing to say: bitcoin's falling volatility is causing problems for exchanges, which rely on volatility for trading volume. Without trading volume, their revenues will fall, leading to a shakeout in 2015. That's scary stuff, but does it hold up? Let's start with the link....