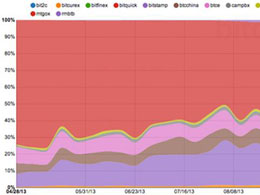

Bitcoin Trading Volume Concentrating in Largest Exchanges

The vast majority of bitcoin trading volume has traditionally been handled by a relatively small number of exchanges. However, the latest data indicates that volume has concentrated even further as smaller exchanges are being pushed aside, leaving them with a much lower share of the total volume of bitcoins traded than just a few months ago. Lost monopoly. Prior to the start of its decline in mid-2013, Mt. Gox had what amounted to an effective monopoly on bitcoin trading volume, often commanding upwards of 80-90% of total US dollar-denominated volume. However, as Mt. Gox's problems....

Related News

It didn't seem like it was terribly long ago that Mt. Gox was leading by miles in terms of being the de facto Bitcoin exchange. Fast forward to early November, and we're finding out that Mt. Gox is not longer, well, leading by miles. In fact, two exchanges are catching up to Gox in trading volume. The first is - and I say this with little to no surprise - BTC China. The Chinese have taken tremendous interest in the digital currency, and as such, BTC China's trading volume is about 571k, compared to Gox's 578. Behind BTC China is BitStamp, with a volume of 547k. There's still a a sizable....

The world’s largest bitcoin market saw a steep fall in trading volumes on the day in which exchanges began charging trading fees at a flat 0.2 percent from midday (Beijing time). In a 1-hour trading period after bitcoin exchanges introduced trading fees, trading volume at BTC China fell over 80%. Huobi and OkCoin, the two other exchanges that were investigated and saw discussions held with the People’s Bank of China saw declines of over 90 percent and 80 percent respectively. The drop in trading volume can be attributed to the lack of automated bitcoin trading, previously making up for a....

CHBTC has become the world’s largest bitcoin exchange when measured by volume in the aftermath of other China-based exchanges removing their no-fee trading policies. At this time, CHBTC has not implemented fees for trading the Chinese Yuan/bitcoin (CNY/XBT) pair. According to cnLedger, the exchange plans to implement trading fees at an as-of-yet undetermined time in the future. BTCC, Huobi, OKCoin and YUNBI Implement Trading Fees. Earlier this week, four of China’s largest bitcoin exchanges added trading fees to their platforms following reviews from regulators at the People’s Bank of....

The recent positive price movement in XRP appears to have triggered a new wave of investors’ interest regarding the coin. XRP has surpassed the largest crypto asset by market cap, Bitcoin, in trading volume across exchanges in South Korea, indicating a shift in market dynamics in the country. With fresh optimism in the cryptocurrency sector, […]

In the long run, suppressing volatility and speculation will be positive for the bitcoin market. Bitcoin trading volume has been plummeting across all major Chinese exchanges. That is not entirely unexpected, considering these platforms have removed most of their margin trading options. Moreover, trading fees have been reinstated across Chinese exchanges, which will heavily impact trading activities. For the time being, this has not impacted the Bitcoin price all that much, though. The one-hour trading volumes across most major Chinese bitcoin exchanges took a big hit. Earlier tonight,....