UK's Official Financial Compensation Fund 'Doesn't Cover Digital Currencies'

The UK's Financial Services Compensation Scheme (FSCS) has warned it won't provide compensation for lost digital currencies such as bitcoin and litecoin. The FSCS pays compensation of up to £85,000 per account holder if their bank, building society or credit union is unable to pay claims against it. This usually happens if the financial services firm in question has stopped trading. Mark Oakes, head of communications at FSCS said: "FSCS protects up to £85,000 of depositors' money in savings and current accounts with UK authorised banks, building societies and credit unions. However,....

Related News

In what could possibly be the surprise of the century, the Financial Services Compensation Scheme (FSCS) in the United Kingdom has stated their coverage does extend out to digital currencies. Mark Oakes, who heads the communications division at the FSCS said, "FSCS protects up to £85,000 of depositors' money in savings and current accounts with UK authorised banks, building societies and credit unions. However, virtual currencies are not regulated by the UK regulators, so FSCS does not provide protection in the event of any losses suffered by consumers." Of course, this really doesn't come....

Cover Protocol will distribute new "coins" to token holders as Binance announces compensation for affected traders. Peer-to-peer coverage market Cover Protocol has published a compensation plan for token holders and liquidity providers affected by the recent hack. As part of the process, the Cover Protocol team took a snapshot at block height 11541218, the last transaction block before the exploit began.Eligible liquidity providers on Uniswap, SushiSwap, and Balancer will receive new COVER tokens based on their share of the liquidity pool on those platforms. Liquidity providers on the....

The fund will greatly expand to cover all aspects of digital currency while also working with related financial institutions. The International Monetary Fund, or IMF, plans to “step up” its monitoring of digital currencies, according to a report by Reuters. This intent, as published in an IMF paper Thursday, details how the fund plans to “manage this far-reaching and complex transition” toward a digitized economy.“Rapid technological innovation is ushering in a new era of public and private digital money,” the report reads, highlighting the benefits of digital assets. “Payments will become....

Storing personal wealth in bitcoin, or any other cryptocurrency, is clearly revolutionary. So much so, it's going to take a long time for mainstream consumers to actually understand the concepts and potential behind these currencies. One of the areas people should rightly be concerned with is the safeguards that are in place when making purchases with digital currency. The UK's established financial institutions already provide certain guarantees and safeguards against fraud and retail disputes. None of these are currently offered by bitcoin services. Here are some of the services that....

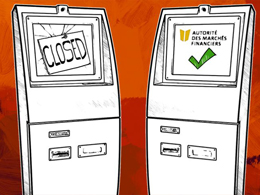

Businesses operating a digital currency automated teller machine (ATM) or an exchange platform in Quebec must obtain the appropriate license from the financial regulator, the Autorité des Marchés Financiers (AMF), in accordance to the Money-Services Businesses Act. The authority, which issued a public statement on Thursday February 12, said that companies involved in trading digital currencies, or which are operating a digital currency ATM, must hold the appropriate license and be authorized by the AMF, the regulatory and oversight body for Quebec's financial industry. The AMF further....