Tera Group Forms Legal Framework For Bitcoin Swaps

A self-proclaimed "global pioneer" in the derivatives marketplace, Tera Group, Inc., today announced a legal framework for bitcoin swaps - effectively allowing investors to swap payments based on how bitcoin is performing in comparison to a fiat currency. Tera, according to their announcement, has put together terms for what is said to be a "multi-million dollar" swap that involves two United States institutions over a 25-day time frame. "The use of a bitcoin swap is an inflection point in the evolution of crypto-currency," said tera CEO Christian Martin. "There is incredible momentum and....

Related News

The world's first bitcoin swap could be just days away, provided Tera Group Inc has its way. The startup derivatives exchange claims to have created the first bitcoin swap and hopes the new derivative will allow financial institutions to hedge the volatility of bitcoin. Tera says it has already constructed the terms for a multi-million dollar swap between two US institutions which would hedge the value of bitcoin against the US dollar. In layman's terms, if betting on derivatives does not get your adrenaline pumping, betting on bitcoin volatility probably should. Standard swap framework....

Tera Group Inc, the operator of the US's first regulated Bitcoin derivative platform Tera Exchange, recently signed a merger agreement with MGT Capital Investment; thereby adding a crucial step that should make the former a publicly listed company. According to the available details, both the parties have currently agreed on some "contemplated" terms of the agreement which will reach its conclusion by March 16th, 2015. But as per now, it is definite that Tera will have a major stake in MGT's common stock shares (at least 70%). From the look of it, Tera however seems to be disinterested....

MGT Capital Investments announced a planned merger with Tera Group, which operates the first regulated U. S. Bitcoin derivatives exchange. The merger will create the first publicly traded U. S. Bitcoin derivatives exchange. As observed by The Wall Street Journal, this is a reverse merger where Tera will take a controlling stake in MGT. Tera doesn't seem too interested in MGT's gaming operations, so the operation is primarily a way for Tera to go public. In other words, Tera is buying a public listing on the stock market for its Bitcoin operations. Tera has played a leading role in the....

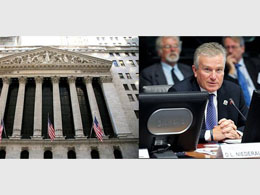

A few weeks ago Bitcoin Magazine reported that Tera Group, which operates the first regulated U. S. Bitcoin derivatives exchange, will take a controlling stake in public company MGT Capital Investment to create the first publicly traded U. S. Bitcoin derivatives exchange. On Monday, Tera Group announced the appointment of former New York Stock Exchange (NYSE) CEO Duncan Niederauer as an advisory director. Before joining NYSE in 2007, Niederauer was managing director and co-head of the Equities Division Execution Services franchise at Goldman Sachs. "This is an excellent opportunity to....

Tera Group, a bitcoin derivatives platform, recently announced that former New York Stock Exchange (NYSE) CEO Duncan Niederauer will be joining their firm as an Advisory Director. The firm has already gained approval from the Commodity Futures Trading Commission (CFTC), which is a financial regulatory agency in the United States, for its trading platform but the bitcoin derivatives have yet to gain accreditation. Tera Group has also entered a reverse merger agreement with MGT Capital, allowing the company to go public. However, the final terms of the agreement are still being discussed,....