Why Bitcoin Businesses Struggle to Get Insurance

As early as the 2nd century BCE, Babylonian traders insured goods from loss at sea by paying a premium on loans. If they paid a little extra when they borrowed, the debt would be forgiven if a freak wave swallowed their cargo en route to market, or if pirates attacked their ships. The bitcoin economy is drastically different, but the need to insure against theft or accidental loss remains. Recovering lost bitcoin is as impossible today as raising ships from the floor of the Mediterranean would have been for the Babylonians thousands of years ago. Fulfilling that need is a different story,....

Related News

The number of hacking attacks on various companies, irrespective of their business have been on a rise across the world. The increasing frequency and the extent of such attacks have driven the costs of obtaining a cyber insurance cover upwards. The premium for such insurance policies vary from business to business, based on the factor of risk associated with them. Among all the businesses, banking, finance and especially cryptocurrency based businesses are the worst affected due to drastic increase in rates and deductibles. Over that, insurers in some cases are also setting a cap to....

As the world becomes more digital and virtual by the hour, some of the oldest professional industries struggle to keep up with the state of technology in today's world. Insurance providers have always had to have a personal touch, but as computers continue to take over consumer use more and more, they need to adapt to the changes in the market. How people pay is also changing, for people and businesses, with Bitcoin digital currency. This was a key topic of discussion at the Risk and Insurance Management Society (RIMS) 2015 Conference in New Orleans last week. Insurance Industry sees The....

SafeShare, an insurance services company has launched a new blockchain based insurance product targetted towards the sharing economy businesses. The Blockchain technology is designed to be secure by default as it stores important cryptocurrency transaction data. The information stored on blockchain is responsible for the execution of transactions and prevention of double spending. The bitcoin blockchain is built around the SHA-256 encryption system to secure data. The open source nature of bitcoin technology has facilitated its adoption in sectors other than mainstream cryptocurrency. It....

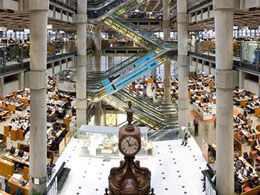

The London based insurance giant, Lloyd's has recently published a report on the risk factor associated with Bitcoin and other digital currencies. The report titled "Bitcoin - Risk factors for insurance" provides a detailed description of different kinds of threats faced by Bitcoin. According to the company, the security risk associated with Bitcoin will never be reduced to zero. The Lloyd's report, authored by multiple experts was specially commissioned to understand and assess the risks associated with insuring Bitcoin based businesses. The report shows that the companies involved in....

More and more Bitcoin businesses are adopting mainstream practices and seeking insurance for their operations. A report by top insurance market operator Lloyd's, published on June 12 and targeted at insurance service providers, highlights the key risk factors for the insurance of Bitcoin operations. Lloyd's, an insurance market located in London, is one of the best-known names in the insurance sector. It operates as a marketplace within which multiple financial backers come together to pool and spread risk. Lloyd's itself does not underwrite insurance business, leaving that to its members.....