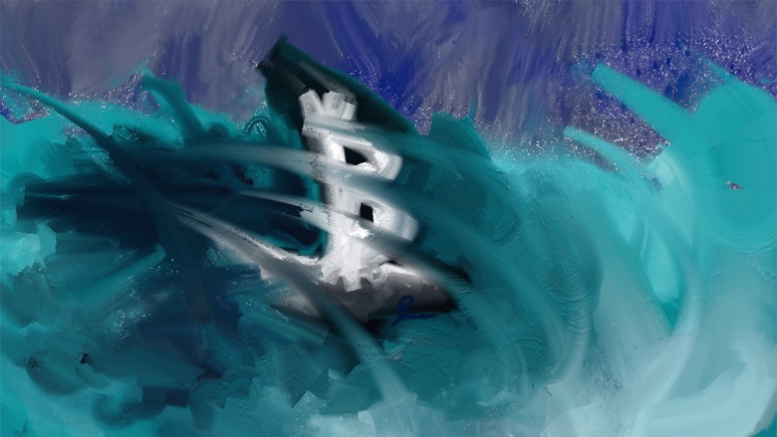

Bitcoin Price Technical Analysis for 20/3/2015 - Troubled Waters

As discussed in yesterday's analysis titled Rebound Likely, Bitcoin has surged to $262.68 after hitting a high of $265.95. The big question now is: Has the selling abated? As can be seen from the 240-minute BTC/USD price chart, Bitcoin has hit a key resistance level of $265, marked as Resistance Line 1. A breakout above this line will set the next target at the Resistance Line 2, i.e. at $280. Now, let's get to what the technical indicators are saying. Moving Average Convergence Divergence - The MACD indicator value of -6.8775 is languishing near yesterday's lows. The Signal Line has also....

Related News

The digital currency Bitcoin has jumped sharply from the lows of $250 registered on March 18 to $268.52 today. In my previous Bitcoin analysis Troubled Waters, I mentioned a possibility of the cryptocurrency surging towards $280 if it broke above $265. The resistance level has been taken out and retested thrice to stamp it as a support level, at least for the short term. Although I still believe that Bitcoin will hit $230 in the medium term, a rise may be witnessed in the near term, which could be used as an opportunity to exit the long positions or create fresh shorts. An analysis of the....

It is not the first time Digital Bitcoin Company chairman Ho gets into troubled waters with law enforcement, as he falsely claimed Bitcoin investors wanted to buy cryptocurrency at a premium price. Bitcoin has attracted the attention of law enforcement agencies all over the world in recent years, yet some people still use cryptocurrency as a way to commit fraud. The chairman of Digital Bitcoin Company was arrested on fraud charges and handed over to the Criminal Investigation Bureau of Taiwan. Trouble Looms Over Bitcoin Trader, Things have gone awry for Digital Bitcoin Company earlier....

The Christmas isn’t turning out to be merry for Bitcoin. The cryptocurrency is struggling near the overhead resistance of $465. It is now trading 1.28% lower at $450.89, raising concerns that the market participants might pull out their funds in the holiday season. As a result, several technical indicators are also showing declines. We advised in the previous Bitcoin price technical analysis Target Achieved that traders should book at least partial profits in their long positions. And for today’s analysis, we will again be using the 4-h BTC-USD price chart from BITSTAMP.

Bitcoin rises more than 2 percent to $430.21, nearing our year-end target of $440. In the previous price technical analysis A No Trade Market, we mentioned that an increasing MFI often causes price appreciation, and we are witnessing just that. The question now is: Would bitcoin be able to extend the gains or will it retrace its steps? Let us try to predict this with the help of technical analysis conducted on the 240-minute BTC-USD price chart. Bitcoin is well poised to increase its duration inside the $400-440 range, at least for the next couple of sessions. There is a high probability....

In the previous Bitcoin price technical analysis Rebounds, we discussed how the cryptocurrency was erasing the losses for the past week. But, the entire positivity was put to rest over the weekend as bears made a comeback and long positions were fast liquidated at the slightest hint of a pullback. Bitcoin, which is now trading at $227.93, has once again come closer to its important buying interest zone of $220-225. As the price decline has pushed the price closer to its crucial support, market participants may also be factoring in a breach of support this time, but I would recommend....