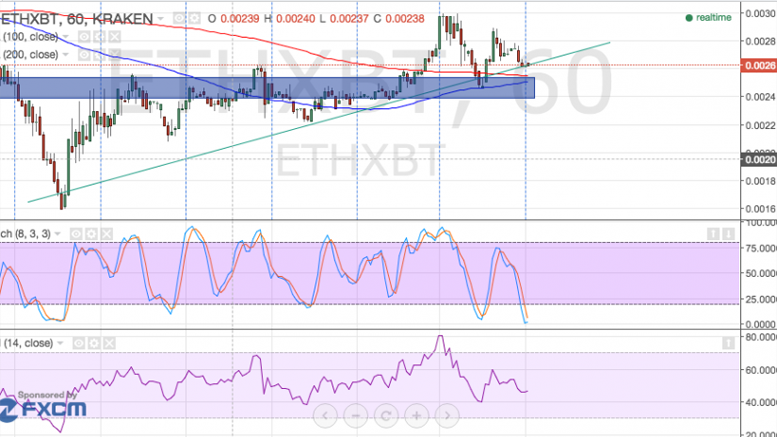

Ethereum Price Technical Analysis - Rising Trend Line Bounce!

Ethereum Price Key Highlights. Ethereum price is still in its short-term uptrend, bouncing off the area of interest highlighted in the previous post. This area of interest lines up with the 200 SMA and a rising trend line visible on the 1-hour time frame. Ethereum price could be on track to testing its previous highs at 0.0030 and possibly make new ones if bullish momentum is sustained. Bullish Divergence Forming. Technical indicators are supporting a potential ethereum price rally, as stochastic is already indicating oversold conditions. The oscillator has yet to climb out of the area....

Related News

Bitcoin Price Key Highlights. Bitcoin price is still on the decline, with the corrective wave from the previous price rally not yet completed. A rising trend line can be drawn connecting the recent lows of bitcoin price action since the start of this year. Bitcoin price might make it all the way down to test the long-term rising trend line support before showing a bounce or resuming its climb. Dynamic Support at SMAs. The rising trend line could serve as the line in the sand for any corrective moves off the long-term uptrend, as a break below this level could send bitcoin price in a free....

Bitcoin price is currently testing the rising trend line visible on its 1-hour time frames and could be ready to resume its climb. Bitcoin Price Key Highlights. Bitcoin price is slowly climbing, moving above a rising trend line on its 30-minute and 1-hour time frames. Price is currently testing this rising trend line support, with technical indicators suggesting that a bounce could take place. A return in bullish pressure could take bitcoin price back up to the previous resistance at $590 or higher. Technical Indicators Signals. The 100 SMA is above the longer-term 200 SMA, which confirms....

Bitcoin price is still hovering close to the long-term rising trend line but could be trying to resume its rally. Bitcoin Price Key Highlights. Bitcoin price has been trending higher on its longer-term time frames, moving above a rising trend line visible on the daily chart. Price recently tested the trend line support and made a bounce, which suggests that bulls are intent on keeping the uptrend intact. The rally is still finding legs but there are technical arguments for a continuation of the climb. Technical Indicators Signals. The 100 SMA is above the longer-term 200 SMA on this time....

Ethereum Price Key Highlights. After forming a head and shoulders pattern indicated in yesterday's technical analysis article, ethereum price broke below the neckline and confirmed the potential selloff. Price also broke below the rising trend line support, adding to the downtrend signals on the 1-hour time frame. Ethereum price could have its sights set on the next visible floor around 0.0200, although a pullback to the broken neckline and trend line support might be seen. Resistance at 61.8% Fib? The 61.8% Fibonacci retracement level is closest to the broken rising trend line and is also....

Bitcoin price is in for another dip to the ascending trend line support, offering an opportunity to buy on dips. Bitcoin Price Key Highlights. Bitcoin price made a strong rally after its bounce off the rising support, as indicated in an earlier article. The $740 area is holding as resistance, possibly spurring another potential correction to the ascending trend line support. Technical indicators are suggesting that the uptrend could continue but that profit-taking is due. Technical Indicators Signals. The 100 SMA is above the longer-term 200 SMA on this time frame so the path of least....