Transaction Fees Increase as Bitcoin Blocks Get Full

By the look of things, there is no improvement in sight anytime soon. The Bitcoin memory pool is full of transactions waiting for network confirmations, and the numbers only keep going up over time. Some people might see this as a sign of how Bitcoin is gaining a lot of popularity, but these confirmation delays are not doing anyone any favors right now. Something strange is going on within the Bitcoin ecosystem, as it has become all but impossible to send transactions to other people by paying a low or standard fee these days. Trouble started brewing when someone figured out how all mined....

Related News

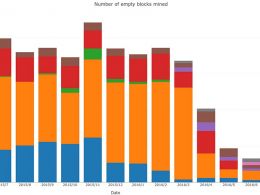

Blocks on the Bitcoin blockchain have a maximum size of 1 MB. Proof of work difficulty is calibrated so 1 block is created every 10 minutes. It is generally accepted a miner would want to maximise the number of transactions it includes in a block as it collects the transaction fees. Logically, with the growing popularity of Bitcoin, the average block size is getting closer to its limit. In this environment, it is surprising to see a number of empty blocks being mined. An empty block is not entirely empty, it has 1 transaction : the coinbase transaction which allocates the mining reward to....

Now that the number of Bitcoin transactions is increasing for an unknown reason, a new debate has started to form on Reddit. Is it harder to increase the number of transactions on the Bitcoin network compared to increasing the transaction fees, or vice versa? On paper, the second option will meet a lot more resistance from the community, but as displayed....

Consistently full blocks are the primary reason that gas prices have reached all-time highs. A report by analytics provider Coin Metrics has delved into the world of Ethererum transaction fees noting that they’re still at highest-ever levels and even a much touted approaching network upgrade is unlikely to alleviate the problem.According to the Ethereum Gas Report by Coin Metrics, median fees on Ethereum have been consistently over $10 for most of 2021. Comparatively, the average Ethereum transaction fee reached just $5.70 at the height of the 2017/2018 bull run.It attributed some of this....

The increasing amounts of Bitcoin transactions have slowly led to an increase in Bitcoin fees as miners favor the transactions with fees as priority transactions. This means that it can take a longer time for a Bitcoin transaction to clear. Some transactions, small ones without fees generally, can be lost to the Bitcoin ether, only to be returned to sender a few day later. Transaction fees have been touted as one of the best reasons to use Bitcoin. The world’s first truly international value transfer system boasts the lowest transaction fees. Though these fees have been quietly rising over....

Bitcoin transaction fees are on the rise again. Fees shot up more than 350% during the last thirty days to Oct. 22. The most significant increase occurred in the last week, as the price of bitcoin soared on growing institutional interest. According to data by Bitinfocharts, it cost an average of $5.75 to send a transaction over the Bitcoin blockchain on Saturday, up from around $1.8 five days earlier. Fees peaked at $6.36 on Oct. 22, as the bitcoin (BTC) price scaled past $13,000, a 2020 high. Just over thirty days ago on Sept. 20, it cost only $1.39, on the average, to get a transaction....