Bitcoin Markets Under Pressure Following Drop in Price and Hash Rate

The combination of weak near term technicals, a dip in hash rate, questions over a secretive miner/Core dev meeting, and sustained interest in ETH/ETC has pushed Bitcoin’s exchange rate down more than $20 over the weekend. While the drama continues to run high in the Ethereum universe, Bitcoin has its own little bit of drama going on for the time being. First of all, with Segregated Witness rolling out to production in the next Core release and rumors of miner dissatisfaction over the past month, a group of seven large miners and over a dozen Core devs attended a closed-door meeting this....

Related News

Soaring hash rate, high electricity costs and BTC price hovering under $20,000 for months is complicating matters for Bitcoin miners. October witnessed a surge in Bitcoin’s (BTC) hash rate which is pushing the metric to a new high of 245 Exahashes per second. These changes led to a sharp decrease in the hash price, resulting in a drop in the profit margins for BTC miners reaching a low of $66.8 USD/PH (per one quadrillion hashes per second) on Oct. 24, 2022.According to Luxor Technologies, “hashprice” is the revenue BTC miners earn per unit of hash rate, which is the total computational....

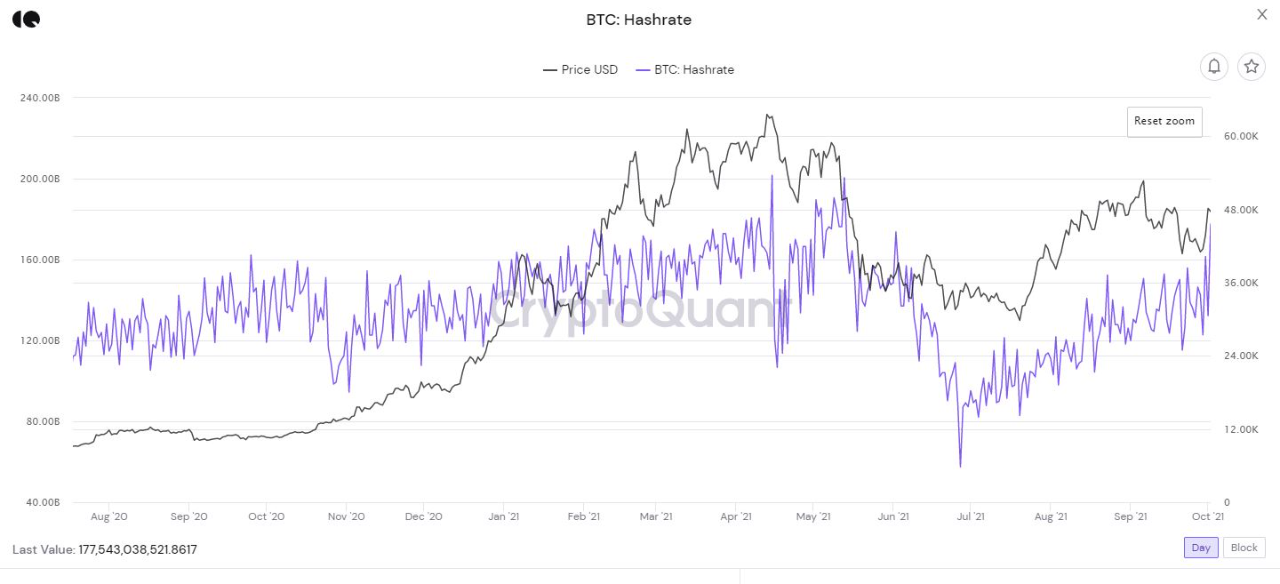

The ratio of Bitcoin price to hash rate presents bulls with a long wait, as hash rate is still migrating. Bitcoin (BTC) has recorded its biggest mining difficulty drop of nearly 28% on July 3, but one model suggests that the BTC price will not bottom until October.In a series of tweets on July 2, investment manager Timothy Peterson flagged the relationship between Bitcoin price and hash rate as arguable evidence that the dip is not over.Bitcoin network hash rate 7-day average. Source: Blockchain.comHash rate model: Long road ahead to Bitcoin bottomBitcoin mining difficulty dropped by an....

As Bitcoin hash rate continues to rise, a new ATH could soon be in sight. Here’s what it might mean for the price based on previous pattern. Bitcoin Hash Rate Continues To Go Up The BTC hash rate has been increasing for the past couple of months after crashing down in June from the all-time-high […]

The upcoming record difficulty drop means mining Bitcoin is about to get a lot more profitable while hash rate slowly returns to the network, Glassnode predicts. Bitcoin (BTC) miners are “unlikely” to pressure BTC price by selling coins in the coming weeks, new data says.As part of its latest weekly report, The Week On-chain, analytics resource Glassnode sought to allay fears of another large miner sell-off.Difficulty drop a gift to remaining minersAmid the ongoing transfer of mining equipment — and therefore Bitcoin hash rate — out of China, fears have emerged over miners selling BTC to....

Hash rate plays a vital role in every Proof-of-Work (PoW) blockchain. It measures the computational drive for all transaction verification and block additions to the network. Hence, the Bitcoin hash rate represents the number of people involved in BTC mining. As the number of miners increases, the hash rate will also increase. This results in maintaining the security and stability of the Bitcoin ecosystem. Many investors will consider hash rates before engaging in any project. Before now, the BTC price and hash rate have maintained a direct proportionality relation. This is because there....