Property, Money or Currency? What is Bitcoin and Why It Matters

Bitcoin has emerged as the leading cryptocurrency of choice ever since it came into being. In the eyes of the users of Bitcoin, the definition of it as a currency might just be very clear but when it comes to the legal definition of Bitcoin, there is still a lack of clarity. Does the classification of Bitcoin matter? Different jurisdictions treat Bitcoin differently. Bitcoin is a true global currency and it can be used in any part of the world. In this type of a scenario, it is but natural that different legal jurisdictions take a different view of what exactly Bitcoin is. In some....

Related News

Smart property is to deeds as Bitcoin is to money. In the same way that Bitcoin revolutionized the concept of currency, smart property revolutionizes the concept of ownership, removing the need for a central authority to say who owns what. Our system of ownership is just one in a growing line of things to be decentralized, but will inevitably be among the most important. The question is, how can we enforce such a system without the firepower backing modern courts? For those of you still trying to grasp this idea, it's helpful to remember that bitcoins are not actually things: Bitcoin is a....

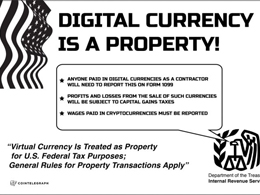

The United States’ tax agency, the Internal Revenue Service, clarified its position on cryptocurrencies Tuesday in a statement. The Internal Revenue Service today issued a notice providing answers to frequently asked questions (FAQs) on virtual currency, such as Bitcoin. These FAQs provide basic information on the U.S. federal tax implications of transactions in, or transactions that use, virtual currency. In some environments, virtual currency operates like “real” currency — i.e., the coin and paper money of the United States or of any other country that is designated as legal tender,....

Futurists imagine a day where robots might own ‘themselves’, and even trade property with other robots. Some believe bitcoin could even become the ‘currency of AI.’ Robotic Bitcoiners. What if robots are self-sovereign entities and they can own property, own money, have legal rights and so forth? “There’s actually a lot of precedence for that,” says Jeff....

In a recent IRS News Release, America's Internal Revenue Service reveals their Virtual Currency Guidance. While Bitcoiners are busy watching the Coinsummit livestream, the IRS Virtual Currency Guidance that was promised many months ago has been leaked. The most noteworthy points are right in the title: Virtual Currency Is Treated as Property for U. S. Federal Tax Purposes. General Rules for Property Transactions Apply. Here is the full release: IRS Virtual Currency Guidance: Virtual Currency Is Treated as Property for U. S. Federal Tax Purposes. General Rules for Property Transactions....

Bitcoin has long been officially given the status of 'Private Money' in Germany. This makes Germany the first country in the World to recognize Bitcoin as a currency, according to report an August 2013 article in Die Welt. Back then, the German Finance Ministry's response to a query from parliamentary Finance Committee member Frank Schaeffler, was that Bitcoin was recognized as having the status of, 'Private Money'. This decision clearly opens the way for Bitcoin while opening the way for potential taxation and other forms of financial regulation. recognized US IRS has it wrong. This....