Marijuana Banking Expert Sites Challenges in The Year Ahead for Legal Marijuana

PayQwick is processing millions in monthly transactions, making marijuana businesses safer and more prepared for 2017.

PayQwick, the only closed-loop payment platform designed for the legal marijuana industry, shares its 2017 industry outlook after voters and regulators across the country have spoken and now legalized medical marijuana in 28 states and recreational marijuana in seven. With the recent passage of Proposition 64, California – the first state to legalize medical marijuana 20 years ago – joins Colorado, Washington, Oregon and Alaska to approve recreational use. Massachusetts and Nevada followed suit.

According to Kenneth Berke, co-founder of PayQwick, which is already processing millions of dollars in legal marijuana transactions each month, the top consideration in the new year is addressing the banking challenges head on. Existing federal laws still prohibit the use and sale of marijuana. Solving the banking problem is the top issue to ensure a profitable, compliant operation will keep its doors open to customers.

Since major banks will not yet touch the industry, PayQwick advises businesses in Washington and Oregon, as well as California startups, on navigating FinCEN and the Cole Memos’ Guidelines for deposit into any financial institution through track and trace compliance.

“Legal medical marijuana is now available to a quarter of the U.S. population so the top priority for businesses looking to tap into this rapidly growing market should be arranging secure, convenient, transparent and traceable payment transactions,” Berke said.

In addition, PayQwick recommends that legal marijuana businesses:

- Lessen the inherent robbery risks of a cash-dependent industry and cultivate a loyal customer base by offering convenient and secure, cashless payment methods such as reloadable cards and smartphone apps.

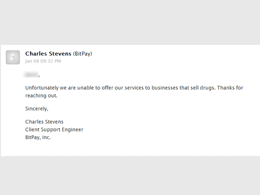

- Avoid crypto-currencies such as Bitcoin, which can trigger red flags for banks and regulators and facilitate money laundering and tax evasion.

- Be cautious of the legality of cash alternatives such as debit/credit cards that can lead to miscoding transactions since marijuana is a Schedule I substance without a merchant category code.

- Pursue online bill pay methods to send and receive payments from ancillary businesses.

- Regularly audit all business and tax accounts to reduce the risk of crime, theft, money laundering and illegal sales of marijuana that can lead to permanent exclusion from the marijuana industry.

Berke, a California-licensed attorney, has extensive experience implementing cash management protocols for marijuana businesses and is well versed on the compliance standards banks must satisfy when working with businesses in the industry. PayQwick’s proprietary payment platform combines the functionality of a PayPal®-type B2B payment platform with a consumer-based, prepaid point-of-sale payment platform that is safe, secure, trackable and traceable.

About PayQwick

PayQwick is a federally registered Money Services Business licensed by the Washington State Department of Financial Institutions (“DFI”) and the Oregon Division of Finance and Corporate Securities (“DFCS”) as a money transmitter. Founded in 2014, PayQwick brings proven payment processing, cash management and banking services to the licensed medical and adult-use (recreational) marijuana industries. PayQwick’s proprietary technology and regulatory compliance platform sets the “gold standard” for providing financial services to the marijuana industry.

For more information, visit: http://www.PayQwick.com/

Related News