Here’s How Bitcoin Could Crash To $28K, Bold On-Chain Data Shows

Bitcoin continues to be stuck in its current range. The first cryptocurrency by market cap has been unable to display clear conviction. The bears have momentum and could go on the offensive soon. At the time of writing, BTC trades at $33,793 with sideways movement across the board. Pseudonym analyst “Coin Casanova” has compiled bearish […]

Related News

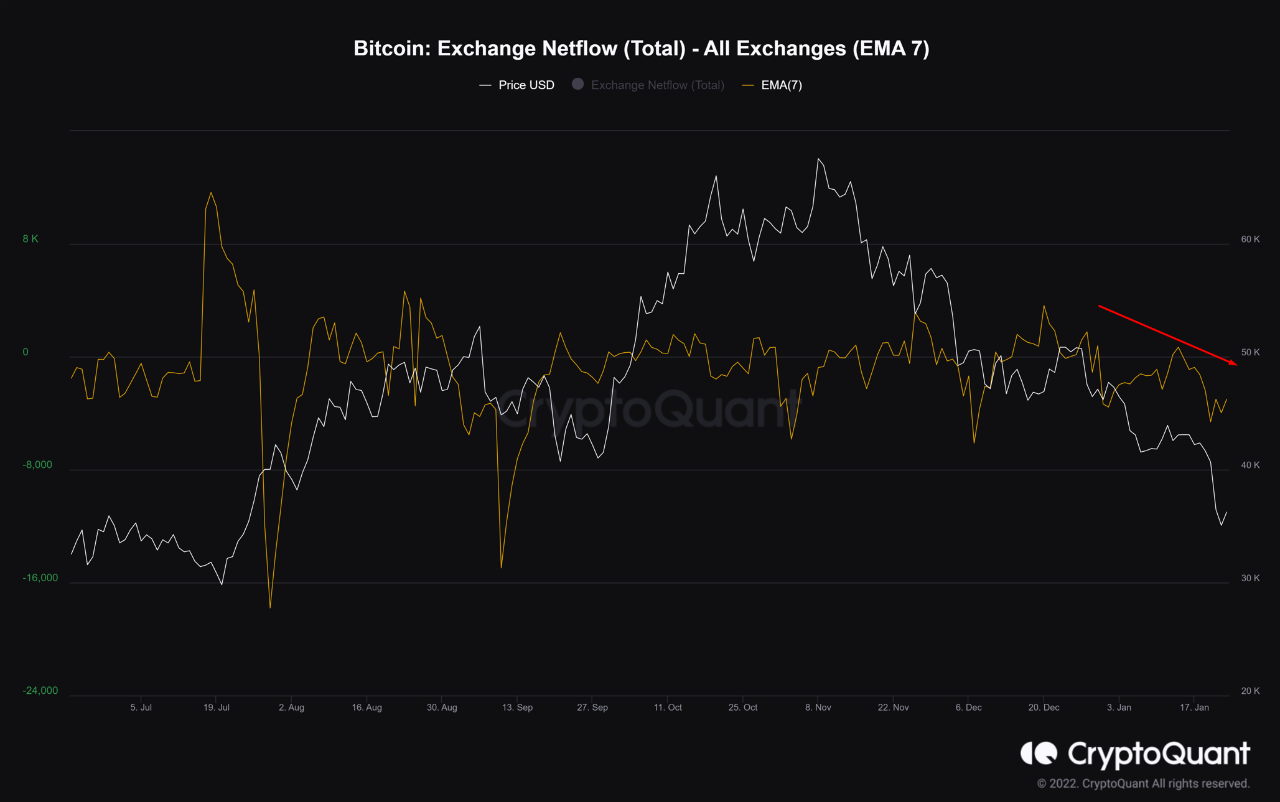

Bitcoin on-chain data shows that the BTC outflows have been gradually heading downwards recently, hinting that a crash could be coming soon. On-Chain Data Shows BTC Outflows Continue To Decrease As pointed out by an Analyst on Twitter, on-chain data reveals Bitcoin outflows have been gradually going down in the past month. The relevant metric here is the BTC netflows. This indicator shows the net amount of coins exiting or entering exchange wallets. Its value is calculated by taking the difference between the inflows and the outflows. When the netflow shows negative values, it means....

With the Bitcoin price falling below $110,000 and the crash continuing to deepen, some revelations have surfaced about why this is happening at this time. Fingers had initially pointed to the bearish macro headwinds as the crypto market got caught in the crosshairs. However, on-chain data shows that it may be much simpler than that, […]

On-chain data shows Bitcoin netflows have increasingly become negative since the crash, meaning investors have been buying the dip. Bitcoin Netflows Becoming More Negative Since The Crash As pointed out by an analyst in a CryptoQuant post, BTC netflows have started to turn more negative since the crash a few days back. The “all exchanges […]

On-chain data shows the Bitcoin Supply in Profit has taken a significant hit following the crash the cryptocurrency has seen recently. Bitcoin Supply In Profit Dropped To Around 81% During The Crash As explained by an analyst in a CryptoQuant Quicktake post, the latest drawdown in the cryptocurrency has resulted in a portion of the […]

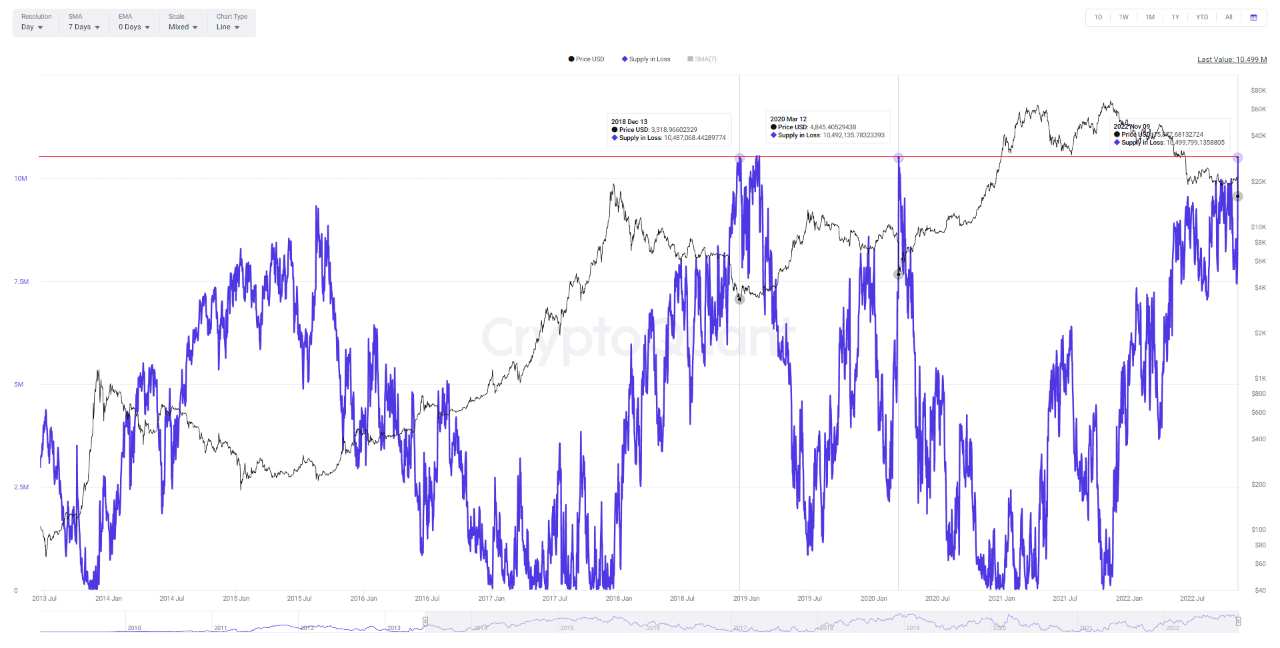

On-chain data shows the amount of Bitcoin supply in loss has now reached levels similar to during the COVID crash and the 2018 bear market bottom. Bitcoin Supply In Loss Spikes Up Following The Latest Crash As pointed out by an analyst in a CryptoQuant post, the BTC supply in loss has set a new record for this year following the FTX disaster. The “supply in loss” is an indicator that measures the total amount of Bitcoin that’s currently being held at some loss. This metric works by looking at the on-chain history of each coin in the circulating supply to see what price it....