Bitcoin Faces More Downside After Recent Crash, Data Shows

Bitcoin suffered a sudden and deep drop in November, losing nearly a quarter of its value and wiping out over $1 trillion across the crypto market. Related Reading: Bitcoin’s Sudden Volatility Jump Signals Options Could Be Calling The Shots—Analyst Whales Trim Positions Before Crash According to on-chain data from CryptoQuant, large holders played a central role. Wallets holding between 1,000–10,000 BTC pared back their stakes in the weeks leading up to the fall. Those big sellers took profits after the October rally, and in many cases selling was steady rather than panicked. When large....

Related News

XRP has been through a rollercoaster over the past few days, tumbling in a crash alongside the rest of the crypto market. The crash drove XRP’s price to a flash low of $1.64 before it recovered to $2.36, with volumes surging 164% above the 30-day average. This flash crash created a notable downside wick on XRP’s price chart, which, according to a technical analyst, is reminiscent of a 2017 price structure that suggests that the cryptocurrency is about to enter into a massive rally. XRP 2017 And 2025 Setup Shows Striking Similarities XRP’s recent flash crash has grabbed....

Data from Glassnode shows that the recent Bitcoin crash was the largest in history in dollar terms, coming in at $2.56 billion. The “corona crash” of March 2020 was the previous biggest, at $1.38 billion. Although 13% gains yesterday brought welcome relief, uncertainty still rules. The question on everyone’s mind is, are we still in […]

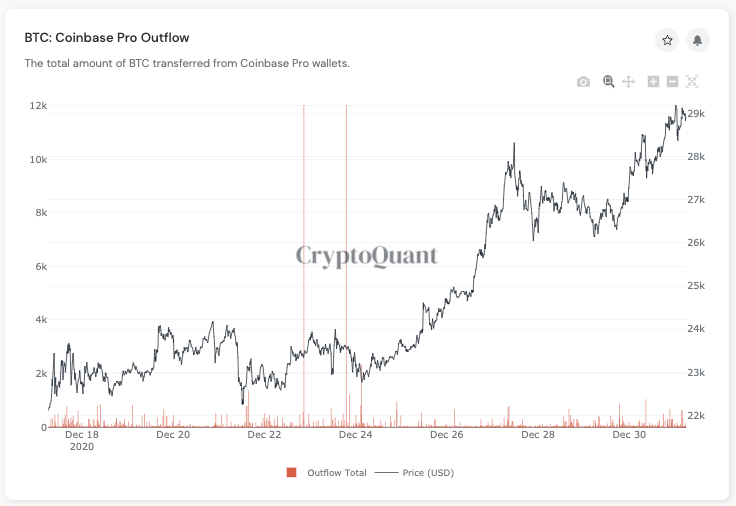

Bitcoin faces the prospects of undergoing a massive downside correction as on-chain data shows a plunge in its over-the-counter deals. According to data fetched by CryptoQuant, the total amount of Bitcoin tokens flowing out of Coinbase Pro’s addresses to their newly-created custodial cold wallets has decreased ever since BTC/USD crossed above $23,000. Coinbase Pro Bitcoin […]

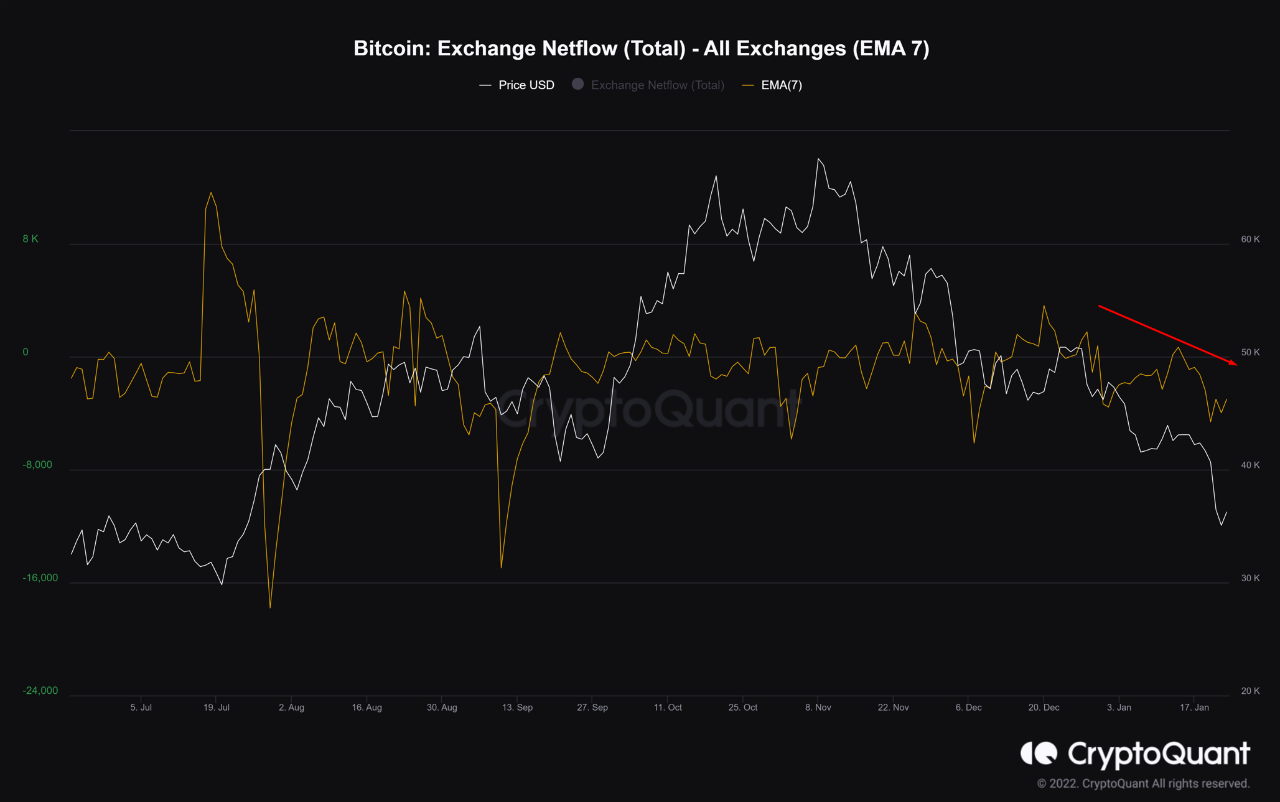

On-chain data shows Bitcoin netflows have increasingly become negative since the crash, meaning investors have been buying the dip. Bitcoin Netflows Becoming More Negative Since The Crash As pointed out by an analyst in a CryptoQuant post, BTC netflows have started to turn more negative since the crash a few days back. The “all exchanges […]

Bitcoin on-chain data shows that the BTC outflows have been gradually heading downwards recently, hinting that a crash could be coming soon. On-Chain Data Shows BTC Outflows Continue To Decrease As pointed out by an Analyst on Twitter, on-chain data reveals Bitcoin outflows have been gradually going down in the past month. The relevant metric here is the BTC netflows. This indicator shows the net amount of coins exiting or entering exchange wallets. Its value is calculated by taking the difference between the inflows and the outflows. When the netflow shows negative values, it means....