This $29B Asset Advisory Is Giving Wealth Managers and Clients a Bitcoin On-Ramp

Mariner Wealth Advisors has tapped crypto firm Eaglebrook for its new bitcoin allocation engine.

Related News

A number of asset managers have cautioned about investing in cryptocurrencies, including UBS Wealth Management, Pimco, T. Rowe Price, and Glenmede Investment Management. “We expect more stringent policy and regulatory controls ahead for crypto as it becomes more mainstream,” said UBS. Asset Managers Caution of Crypto Investing A number of asset managers have expressed caution on cryptocurrency after the recent price swings, including UBS Wealth Management, Pimco, T. Rowe Price, and Glenmede Investment Management, the Financial Times reported Monday. UBS Wealth Management....

Wells Fargo, one of the largest wealth managers in the U.S., has reportedly started offering crypto investments to its wealth management clients. Wells Fargo Offers Crypto Exposure A spokesperson for American financial services company Wells Fargo reportedly confirmed to Business Insider Friday that the company has started offering cryptocurrency exposure to its wealth management clients. Wells Fargo’s wealth and investment management arm, which includes the firm’s private banking services and Wells Fargo Advisors, is one of the largest U.S. wealth managers. It oversees nearly....

“Things are much more encouraging, even though this is clearly a time of pain," said Wave Financial’s head of business development Mike Jones. Two executives at Wave Financial, an asset management firm providing bespoke strategies to high-net-worth individuals and entities, have reported seeing increased institutional demand for crypto products amid the bear market.Speaking to Cointelegraph at the Blockchain Futurist Conference in Toronto on Wednesday, Wave Financial’s head of business development Mike Jones said institutional investment in crypto could be driven by the high end of wealth....

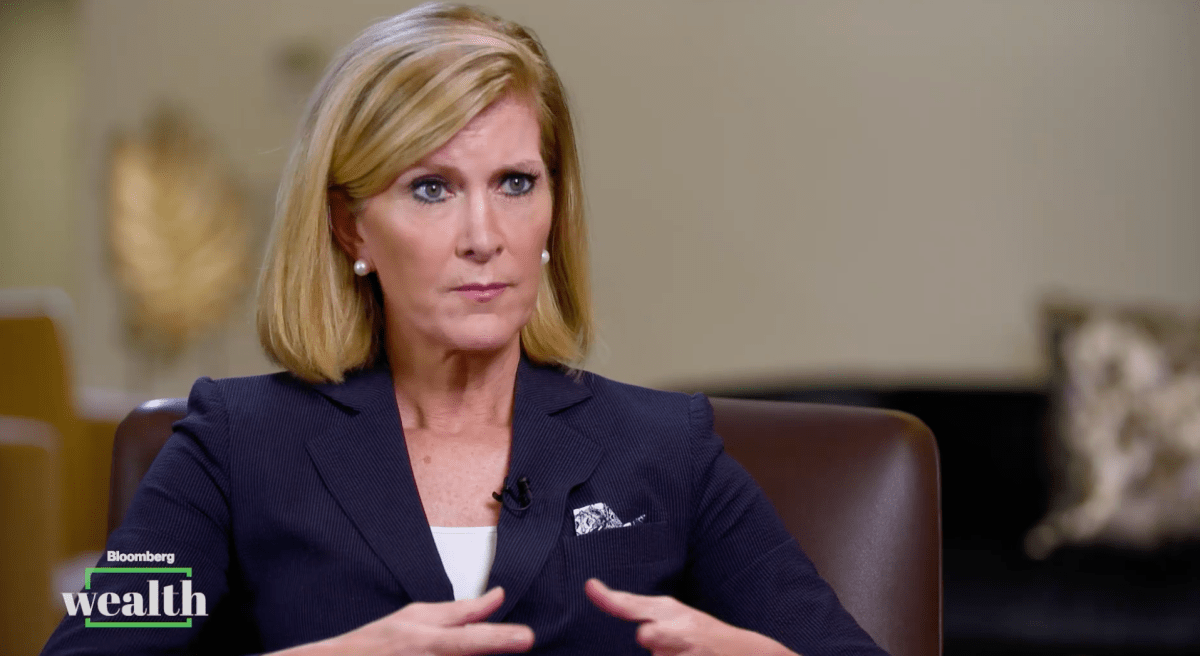

JPMorgan says a lot of its asset and wealth management clients think cryptocurrency is an asset class and they want to invest in it. “Our job is to help them to put their money where they want to invest,” said the CEO of J.P. Morgan Asset & Wealth Management. A Lot of JPMorgan Clients Consider Cryptocurrency an Asset Class Mary Callahan Erdoes, J.P. Morgan Asset & Wealth Management’s CEO, talked about her firm’s approach to cryptocurrencies in an interview with Bloomberg Wealth, published Tuesday. JPMorgan Chase’s asset and wealth management line of business....

J.P. Morgan's head of wealth management says clients are increasingly viewing Bitcoin as an asset class.