Why This Bitcoin Bear Market Is Among The Worst Ever: CryptoQuant Researcher

The price of Bitcoin is nearly 45% away from its all-time high of $126,080, reflecting a worsening market climate over the past few months. One of the indicators that confirmed the emergence of the bear market was the breach of the 365-day moving average to the downside late last year. Using this metric, a prominent […]

Related News

Glassnode’s senior researcher has revealed how Unrealized Loss on the Bitcoin network is still smaller than even mild bear markets in the past. Bitcoin Relative Unrealized Loss Hit Just 1.3% Recently In a new post on X, senior researcher at on-chain analytics firm Glassnode, CryptoVizArt, has talked about how Bitcoin currently compares to past bearish […]

Crashing from an all-time high at around $69,000, Bitcoin has lost over 70% of its value since November 2021. New data reveals that BTC’s price might have entered one of its worst bear markets since its inception, as the cryptocurrency loses critical levels and remains trading in the red on high timeframes. Related Reading: Celsius […]

Though on-chain metrics point to the worst Bitcoin bear market on record, they also highlight hodlers' growing resilience. While the current bear market may be the worst on record, on-chain metrics signal that the Bitcoin (BTC) network is becoming increasingly resilient, said Glassnode analyst James Check during a recent interview with Cointelegraph. In particular, Check refers to the amount of Bitcoin holders who don’t sell even in extreme market conditions, which has become much higher than in previous bear markets. “Cycle after cycle, that floor of hodlers is higher, the amount of....

Recent on-chain analysis by Glassnode has shown that the current Bitcoin bear cycle is playing out as the worst one in history. Several factors have contributed to making the current crypto bear market the worst ever recorded as most Bitcoin (BTC) traders are underwater and continue to sell at a loss, according to Glassnode.Blockchain analysis firm Glassnode’s Saturday report titled “A Bear of Historic Proportions” outlines how Bitcoin’s current dip below the 200-day moving average (MA), negative deviation from realized price and net realized losses have conspired to make 2022 the worst in....

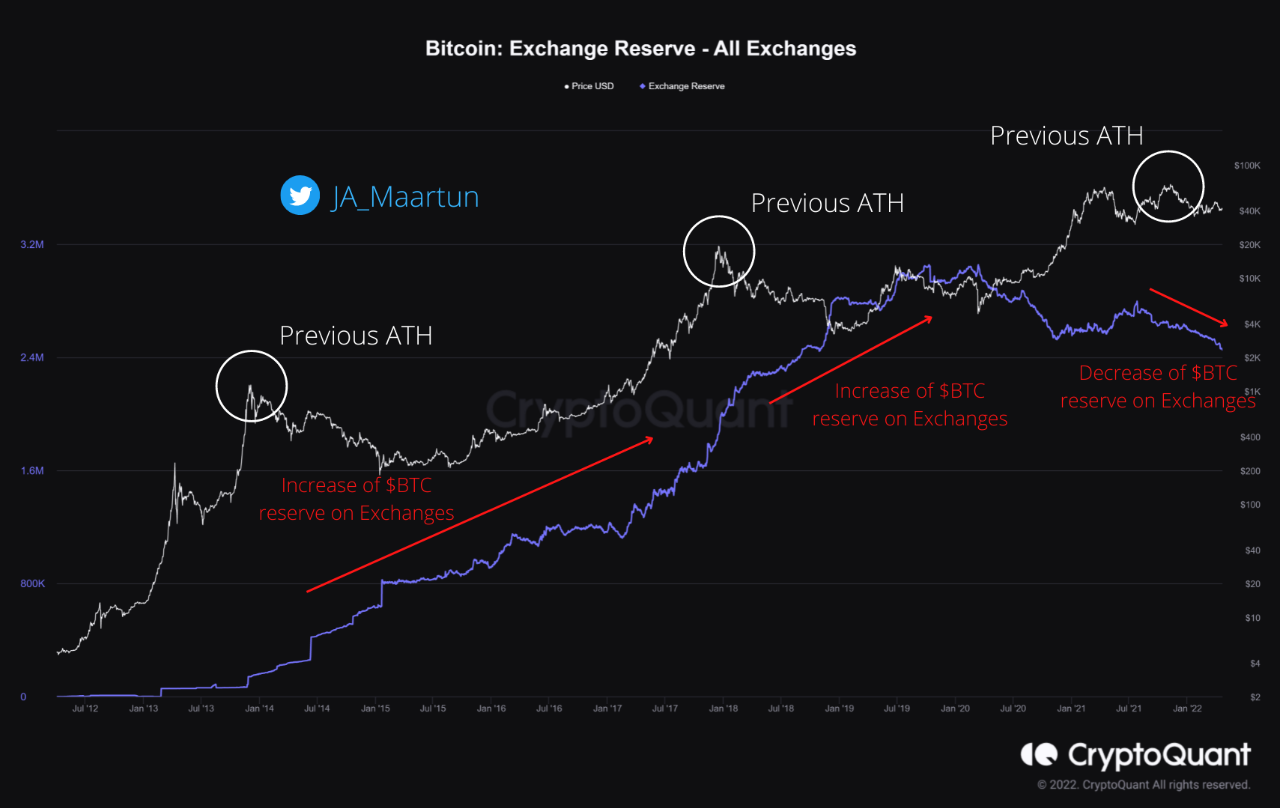

A quant has explained using on-chain data why the current Bitcoin bear market looks to be different from the previous ones. Quant Suggests This Bitcoin Bear Market Is Unlike The Rest As explained by an analyst in a CryptoQuant post, the exchange reserve continuing to trend down since the price all-time high isn’t typical of […]