Quant Explains How Bitcoin On-Chain Data Can Identify Peaks Vs Shakeouts

A quant explains how Bitcoin on-chain data may be used to identify whether a high was because of peak formation or due to a shakeout. Open Interest, Funding Rates, And LTH-SOPR May Signal Whether A Peak Vs A Shakeout As explained by an analyst in a CryptoQuant post, a combination of different on-chain indicators may be able to identify whether a high means the price is forming a peak or if it’s just a shakeout. The relevant Bitcoin indicators here are the open interest, the funding rates, and the LTH-SOPR. Before considering the trend of each, here are some quick explanations of what....

Related News

On-chain data shows Bitcoin whales are dumping as they make up almost 90% of the transactions to exchanges, but BTC holds support above $60k. Bitcoin Exchange Whale Ratio Says Nearly 90% Of Transactions Are From Whales As pointed out by a CryptoQuant post, BTC has continued to hold support above $60k despite on-chain data showing whales are dumping their coins. The indicator of relevance here is the “exchange whale ratio.” This metric measures the ratio between the top ten inflow transactions to exchanges and the total volume of Bitcoin moving to exchanges. With this ratio, the....

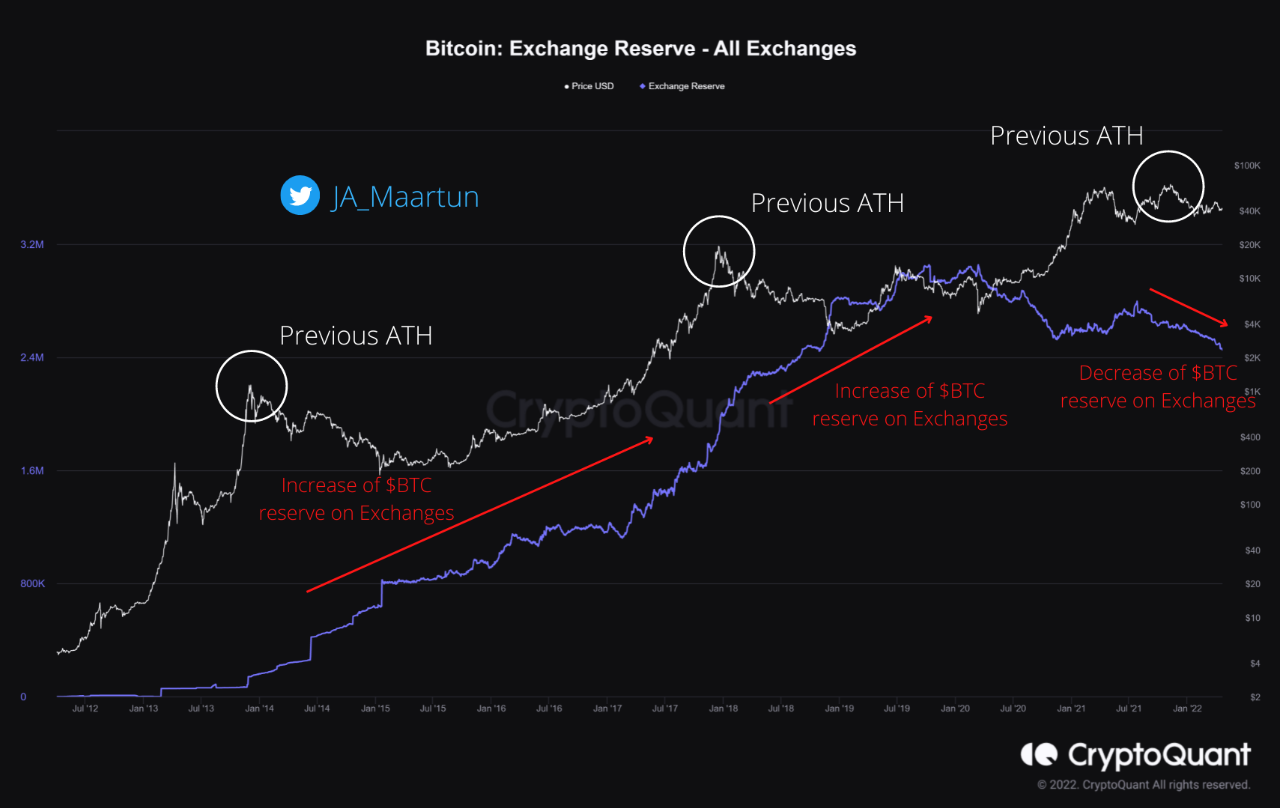

A quant has explained using on-chain data why the current Bitcoin bear market looks to be different from the previous ones. Quant Suggests This Bitcoin Bear Market Is Unlike The Rest As explained by an analyst in a CryptoQuant post, the exchange reserve continuing to trend down since the price all-time high isn’t typical of […]

A quant has explained how the Bitcoin exchange reserve on-chain indicator differs between the current crash and that of May’s. After Spiking Ahead Of The Crash, Bitcoin Exchange Reserves Have Resumed Downtrend As explained by an analyst in a CryptoQuant post, the current trend in BTC exchange reserves is quite different from when the crypto […]

Quant (QNT) is the first blockchain OS that enjoyed continued gains in the last week despite other coins facing turbulent times. The top-30 coin has enjoyed a five-day upswing, gaining over 34%. As of writing, Quant’s price is trading at $198, although it broke its $206 resistance during the day. The token is experiencing a resurgence that has seen it beat Bitcoin (BTC) and Ethereum (ETH) over the same period. However, it’s still trading at about 50% below its all-time high of $427.42. Related Reading: Crypto Won’t See Bull-Run Anytime Soon, This Expert Explains Why Why Is....

As Bitcoin rallies past $57k, Quant explains using on-chain analysis why the cryptocurrency may see a pullback here. Bitcoin Funding Rate And Futures Open Interest Show Rising Values As explained by an analyst in a CryptoQuant post, some BTC indicators are showing values that have historically signaled that a correction could be coming soon. The first metric of relevance is the Bitcoin funding rate, which is defined as the periodic payment that futures contract traders have to pay. Positive values imply most traders are bullish and long traders are paying this fee to short traders. While....