70% Bitcoin Crash Incoming? CryptoQuant CEO Says It Depends On This

Bitcoin’s latest drawdown is being framed less as a technical breakdown and more as a liquidity problem, with Ki Young Ju arguing that the key inputs that sustained the rally fresh capital inflows have stalled. In that setup, he says, calls for a full-cycle, -70% style capitulation hinge on a single variable: whether Strategy turns from buyer to meaningful seller. Will Bitcoin Experience Another -70% Bear Market? In a Feb. 1 post, Ki said “Bitcoin is dropping as selling pressure persists, with no fresh capital coming in.” He pointed to a flatlining Realized Cap as evidence that incremental....

Related News

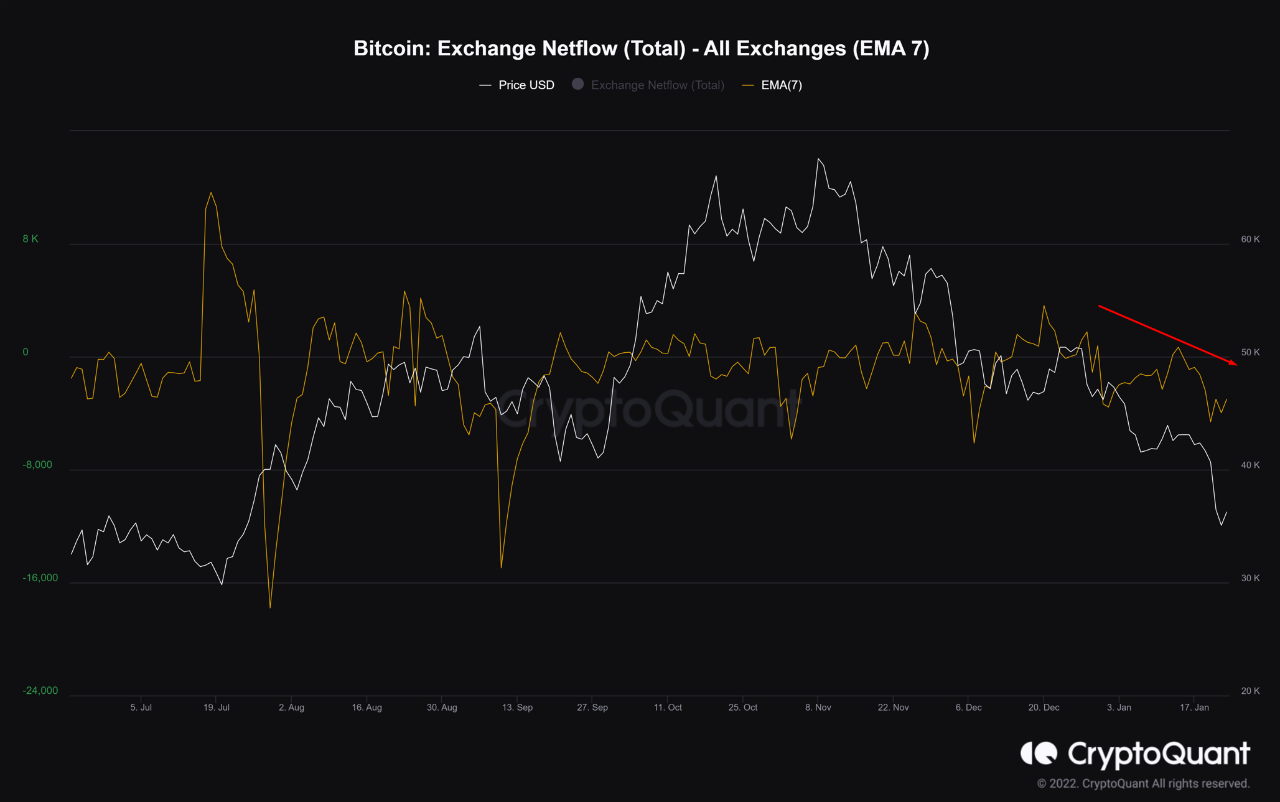

On-chain data shows Bitcoin netflows have increasingly become negative since the crash, meaning investors have been buying the dip. Bitcoin Netflows Becoming More Negative Since The Crash As pointed out by an analyst in a CryptoQuant post, BTC netflows have started to turn more negative since the crash a few days back. The “all exchanges […]

On-chain data shows the Bitcoin Supply in Profit has taken a significant hit following the crash the cryptocurrency has seen recently. Bitcoin Supply In Profit Dropped To Around 81% During The Crash As explained by an analyst in a CryptoQuant Quicktake post, the latest drawdown in the cryptocurrency has resulted in a portion of the […]

A quant has explained how the Bitcoin exchange reserve on-chain indicator differs between the current crash and that of May’s. After Spiking Ahead Of The Crash, Bitcoin Exchange Reserves Have Resumed Downtrend As explained by an analyst in a CryptoQuant post, the current trend in BTC exchange reserves is quite different from when the crypto […]

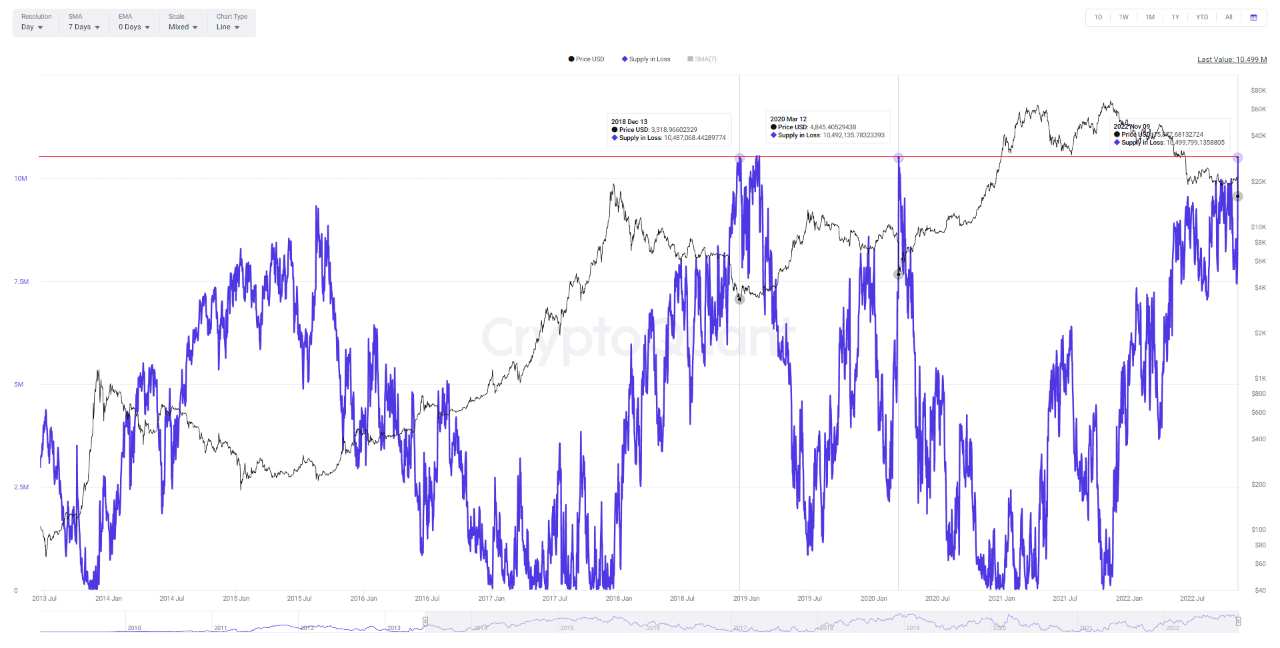

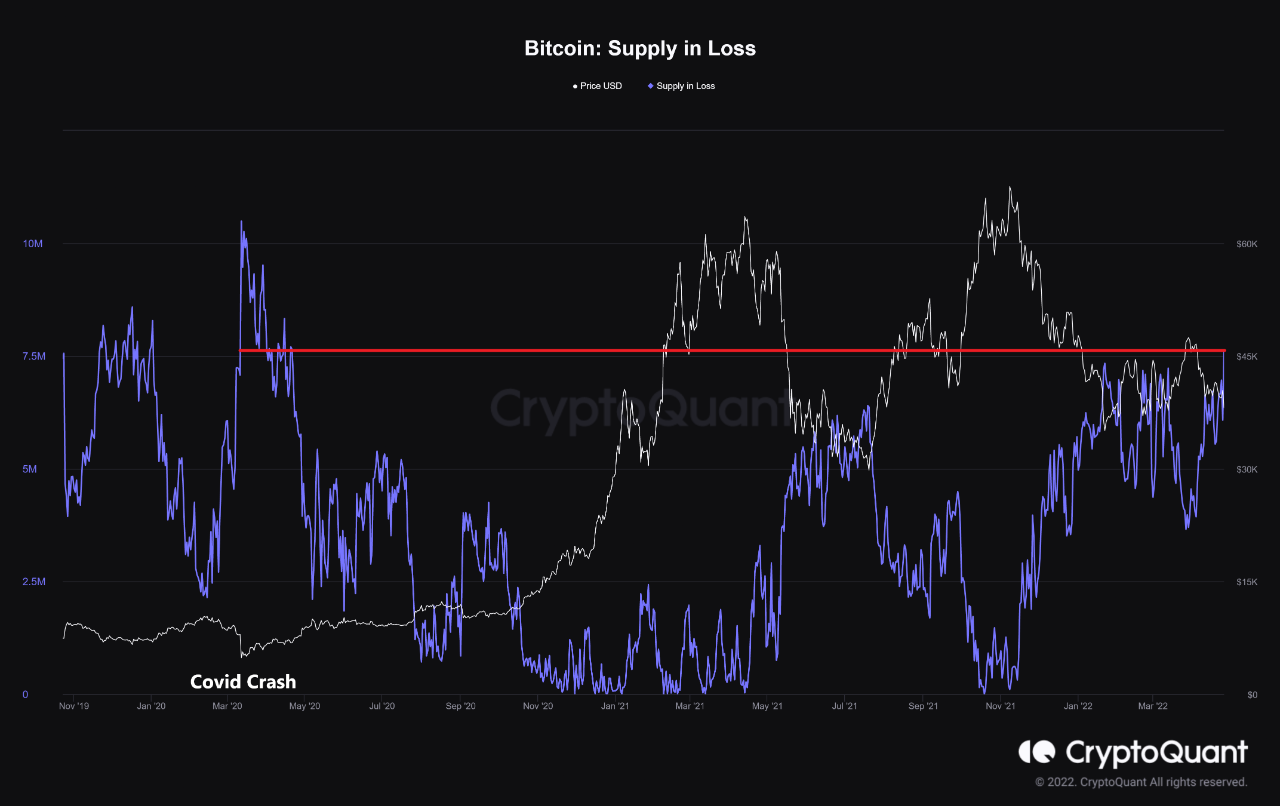

On-chain data shows the amount of Bitcoin supply in loss has now reached levels similar to during the COVID crash and the 2018 bear market bottom. Bitcoin Supply In Loss Spikes Up Following The Latest Crash As pointed out by an analyst in a CryptoQuant post, the BTC supply in loss has set a new record for this year following the FTX disaster. The “supply in loss” is an indicator that measures the total amount of Bitcoin that’s currently being held at some loss. This metric works by looking at the on-chain history of each coin in the circulating supply to see what price it....

On-chain data shows the amount of Bitcoin supply in loss has now risen to the highest value since the COVID-19 crash. Bitcoin Supply In Loss Now Measures Around 7.6M BTC As pointed out by an analyst in a CryptoQuant post, the BTC supply in loss hasn’t shown such high values since the first half of […]