Bitcoin Shrugs Mt. Gox Fears: Why Is Daily BTC Exchange Inflow So Low?

Bitcoin defies gravity and is surprisingly resilient against a wave of selling pressure from the Mt. Gox distribution. As of writing, not only is BTC firm above $60,000 but has managed to stand above $62,500, a level of interest especially by traders. So far, Bitcoin remains in an uptrend, and upbeat traders are looking at […]

Related News

Bobby Lee, BTCC’s co-founder and CEO recently tweeted a bitcoin price prediction, which is between $5,000 and $11,000 by 2020, after the block reward halving. The entrepreneur, who regularly makes predictions, also stated the daily inflow would scale accordingly – from the current $2 million a day level, up to $5-$10 million a day. #Bitcoin price target in 2020; after block halving: USD $5k-$11k Assuming $5-$10 million daily flow into #BTC by then. (Today: $2m daily in). — Bobby Lee (@bobbyclee) February 26, 2017. Bobby Lee also reminded his 5,600 Twitter followers his “medium-term” price....

On-chain data shows that shortly after crypto exchange Binance observed Bitcoin inflow of around 12k BTC, price fell by almost 5%. Huge Bitcoin Inflow To Binance As pointed out by a CryptoQuant post, inflow of around 12k BTC was seen on Binance, the largest crypto exchange by market volume. The Bitcoin inflow is an indicator that shows the total amount of BTC transferred to a crypto exchange from a personal wallet. As investors usually send their crypto to exchange wallets for cashing out, altcoin purchasing, etc., the indicator’s value going up would imply there is some selling....

On Sunday, February 21, the price of bitcoin touched a new all-time high (ATH) at $58,354 and at the time, inflow into exchanges spiked as well. According to data from the onchain analysis firm, Santiment, stats indicate that exchange inflow jumped 11x on Sunday and data also shows one whale address was responsible for the second-largest bitcoin transaction in 2021. Second-Largest Bitcoin Transaction and 11x the Exchange Flow Shakes the Crypto Market Bitcoin prices jumping to new heights has sparked a lot of crypto market movement in recent months and even ancient UTXOs waking up after....

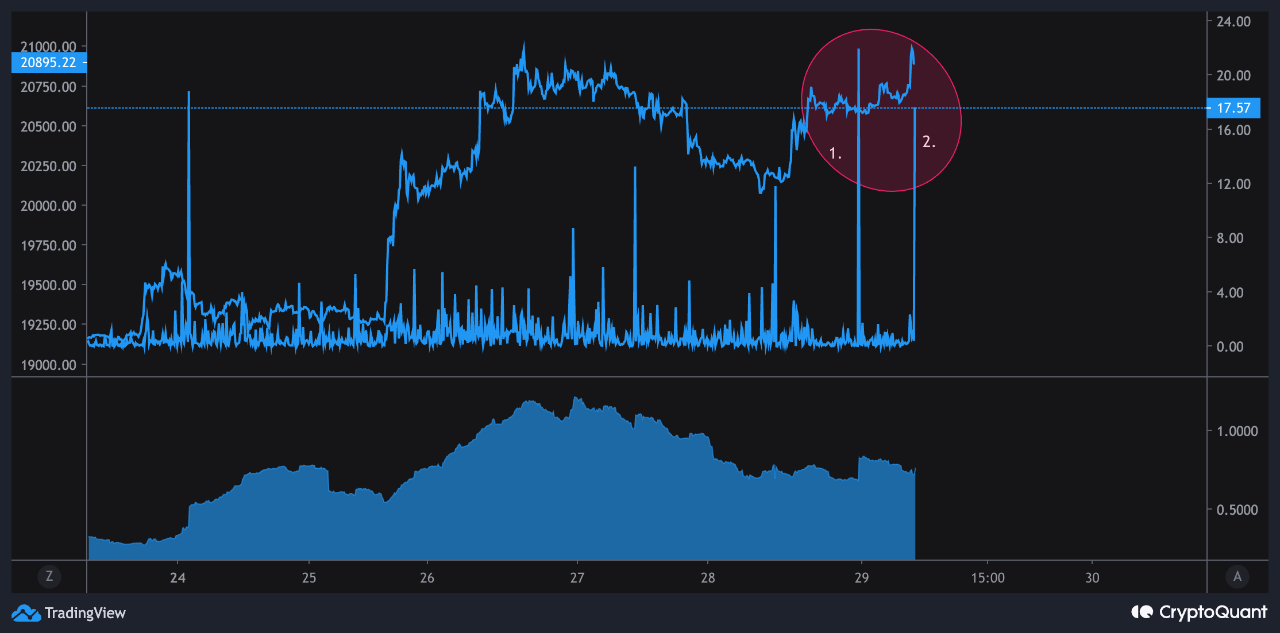

On-chain data shows the Bitcoin exchange inflows have spiked up over the last day, something that could prove to be bearish for the price of the crypto. Bitcoin Exchange Inflow Mean Has Observed Two Spikes In The Past 24 Hours As pointed out by an analyst in a CryptoQuant post, the two exchange inflow mean spikes amounted to around 21 BTC and 17 BTC respectively. The “exchange inflow mean” is an indicator that measures the mean amount of Bitcoin being transferred to the wallets of centralized exchanges per transaction. It’s different from the normal inflow metric in that....

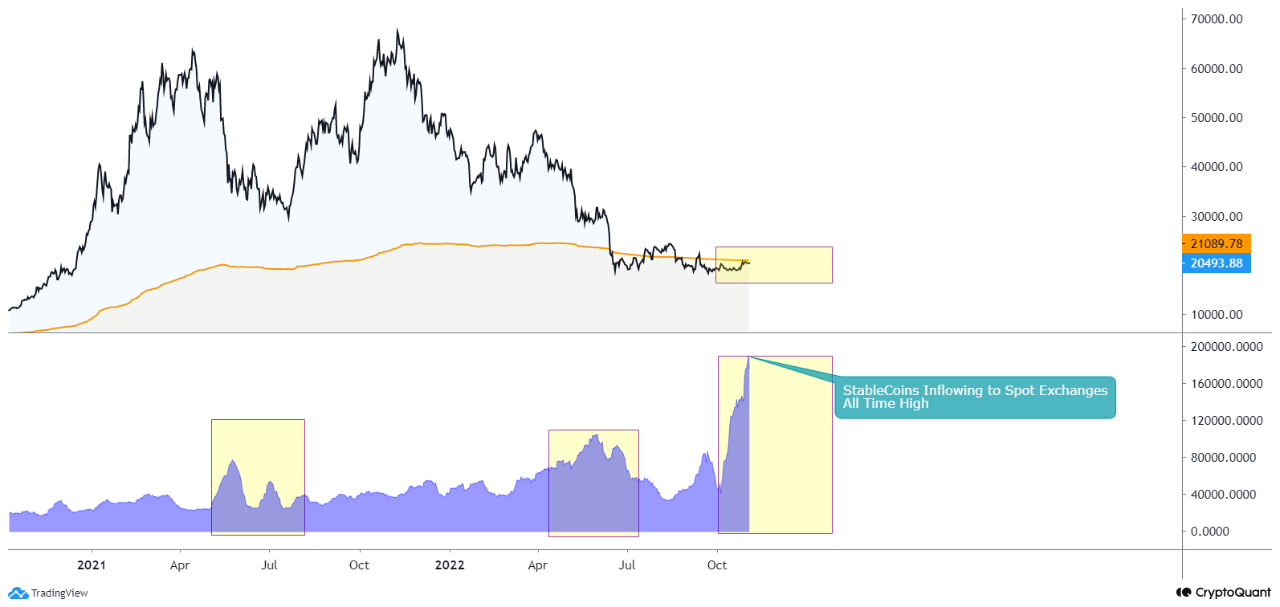

On-chain data shows the stablecoin exchange inflow mean has reached a new all-time high, here’s why this might prove to be bullish for Bitcoin. Stablecoin Exchange Inflow Mean Has Surged Up To A New ATH Recently As pointed out by an analyst in a CryptoQuant post, these inflows can be positive for Bitcoin in the long term, but might be bearish in the short term. The “stablecoin exchange inflow mean” is an indicator that measures the average amount of stablecoins per transaction going into the wallets of centralized exchanges. As stablecoins are relatively stable in value....