Mt. Gox Creditors Opt To HODL Bitcoin Rather Than Sell, CryptoQuant Data Shows

Amid the recent recovery from a significant price correction of over 25% that sent the Bitcoin price to a 6-month low of $53,500, the largest cryptocurrency on the market has since recovered to trade in the $66,000 to $68,000 range despite the start of Mt. Gox creditor repayments. Investors, buoyed by prospects of continued price appreciation, have adopted a HODL stance, opting to retain their assets rather than selling them off following the alleged hack suffered by the Bitcoin exchange in 2011. BTC Hodlers Stand Firm Data from market intelligence platform Arkham reveals that Mt. Gox....

Related News

Trezor users can now buy and sell non-KYC bitcoin directly from their hardware wallets thanks to an integration with P2P platform Hodl Hodl.

On-chain data shows Bitcoin miners have held strong and not dumped the coin despite the recent uncertainty due to the Russian invasion of Ukraine. Bitcoin Miners Show Diamond Hands As They Continue To Hodl As pointed out by an analyst in a CryptoQuant post, the BTC miner reserve hasn’t observed any significant falls recently despite […]

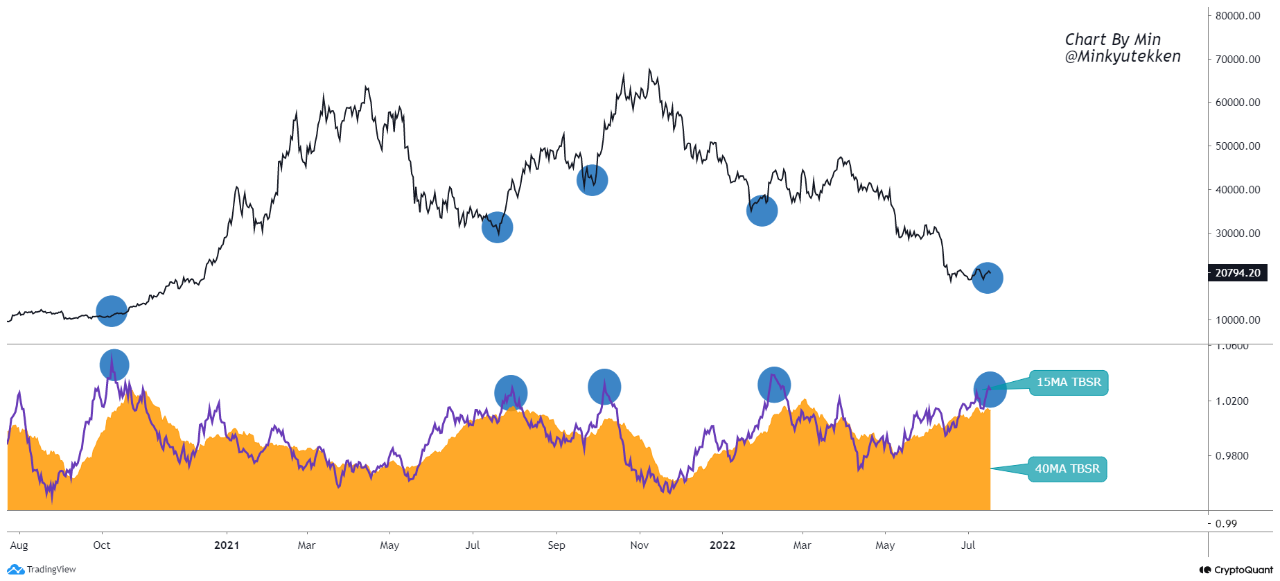

On-chain data shows the Bitcoin taker buy/sell ratio is now lighting up a “buy” signal as the price of the crypto begins to take off. Bitcoin Taker Buy Sell Ratio Suggests Now May Be A Good Time To Buy As explained by an analyst in a CryptoQuant post, the taker buy sell ratio metrics can be used to find viable entry and exit spots in the market. The “Bitcoin taker buy volume” is an indicator that measures the volume of buy orders filled by takers in perpetual swaps. Similarly, the “taker sell volume” measures the amount of sell orders. The “taker....

On-chain data shows the Bitcoin taker buy/sell ratio started showing a green signal shortly before the surge above $22k. Bitcoin Taker Buy/Sell Ratio Is Now Showing a “Buy” Signal As pointed out by an analyst in a CryptoQuant post, the BTC taker buy/sell ratio suggested a bounce not too long before the rally today. The […]

After arousing confusion with incomplete communication and forced liquidations on lending contracts, Hodl Hodl explains what happened.