Market correction vs. bear market: Key differences explained

Market corrections and bear markets both involve price declines, but knowing how to differentiate between the two is crucial in protecting your investment portfolio. Market correction vs. bear marketTo summarize, here are some of the key differences between the two:While corrections and bear markets can be daunting, remember they're normal occurrences within a healthy economy. Learning to differentiate between the two will allow you to navigate them better.In terms of recovery time, markets tend to recover from corrections faster—typically within a couple of months. Bear markets, however,....

Related News

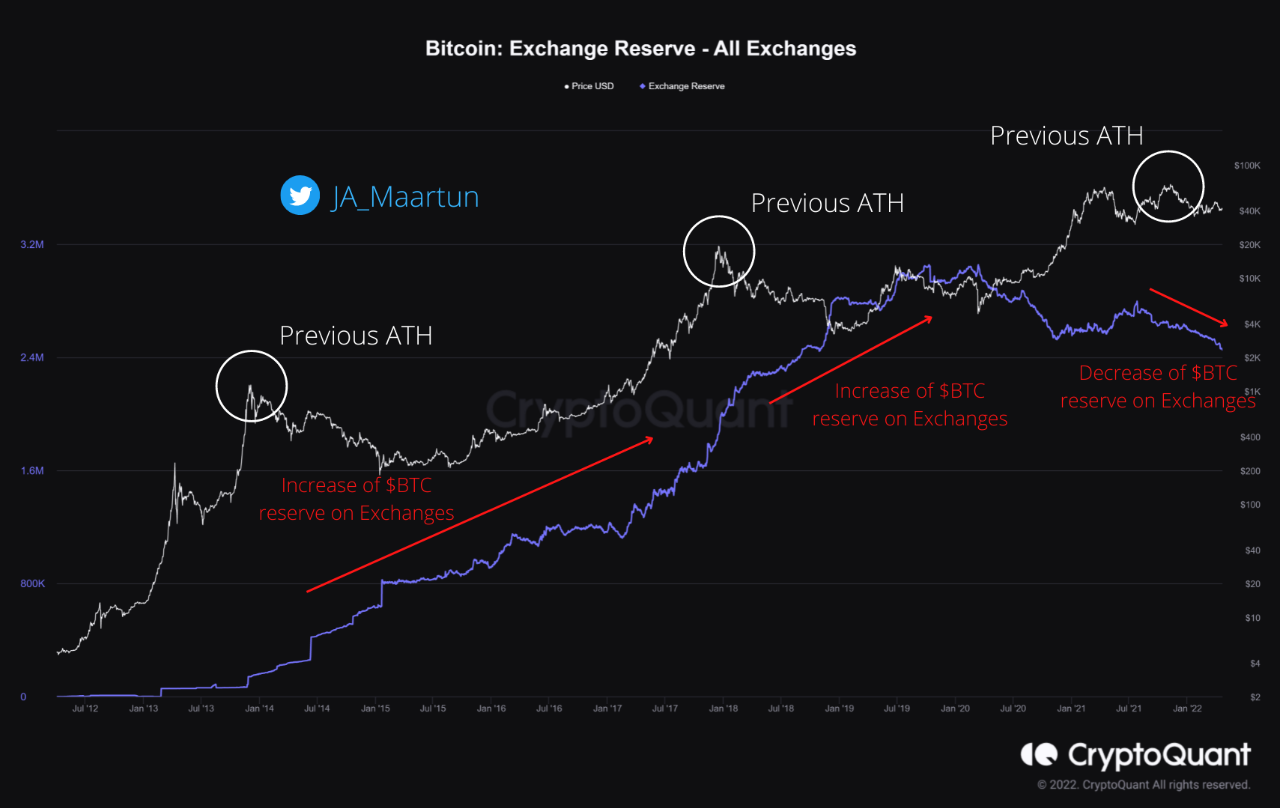

A quant has explained using on-chain data why the current Bitcoin bear market looks to be different from the previous ones. Quant Suggests This Bitcoin Bear Market Is Unlike The Rest As explained by an analyst in a CryptoQuant post, the exchange reserve continuing to trend down since the price all-time high isn’t typical of […]

The recent bitcoin correction down from its all-time high has had the market in a panic in the past week. However, not everyone has seen it as a bad omen. The digital asset’s price had gone down below $60,000 causing investors to believe the bear market had arrived. Mostly, small-time investors had been hit the most by panic as sell-offs happened through the space. Nevertheless, the correction was bound to happen following the incredible run that bitcoin had. Market corrections are always normal and expected after a bull rally but market analysts have pointed out that this particular....

Rejoice! The bear market might be over. That’s the main thesis behind July’s “The Bitcoin Monthly” report. “Because bitcoin’s price did not rise parabolically during the 2021 bull market, its bear market correction could be over,” ARK reasons. And it makes sense, the numbers seem to suggest it, and it feels like it. However, are we fooling ourselves? Is ARK’s reasoning wishful thinking? Let’s examine the data and see what it tells us. First of all, “bitcoin closed the month of July up 16.6%, rising from $19,965 to $23,325, its most significant gain since October 2021.” So far, so good. Can....

Based on historical records, after every Bitcoin (BTC) bull run, a bear market hits, and this cycle may be no different. Analysts forecast that the upcoming bear market may see the price of Bitcoin dropping as low as $25,000. This decline would represent a whopping 77% crash, pushing BTC to a possible market bottom. Analyst […]

With only a 30% pullback on the books, it is hard to consider the most recent consolidation phase in Bitcoin much of a correction. But whatever base is currently being built within this range, could act as the next bear market botton after the leading cryptocurrency by market cap tops out and the cycle restarts […]