Bitcoin whales send BTC to futures exchanges in ‘classic’ bottom signal

Avoiding fallout from positions “putting in a local bottom” has been standard practice for prior BTC price bottoms, one analyst shows. Bitcoin (BTC) whales are betting on a rebound as fresh data shows “classic” bottom behavior.According to on-chain analytics platform CryptoQuant, large-volume investors are moving coins to derivatives exchanges en masse this month.Analyst: Whales protectin positions “forming a local bottom”As BTC/USD hit its lowest levels since the end of June, whales were responding kind.In one of its Quicktake market updates posted on Sept. 7, CryptoQuant analyst Maartunn....

Related News

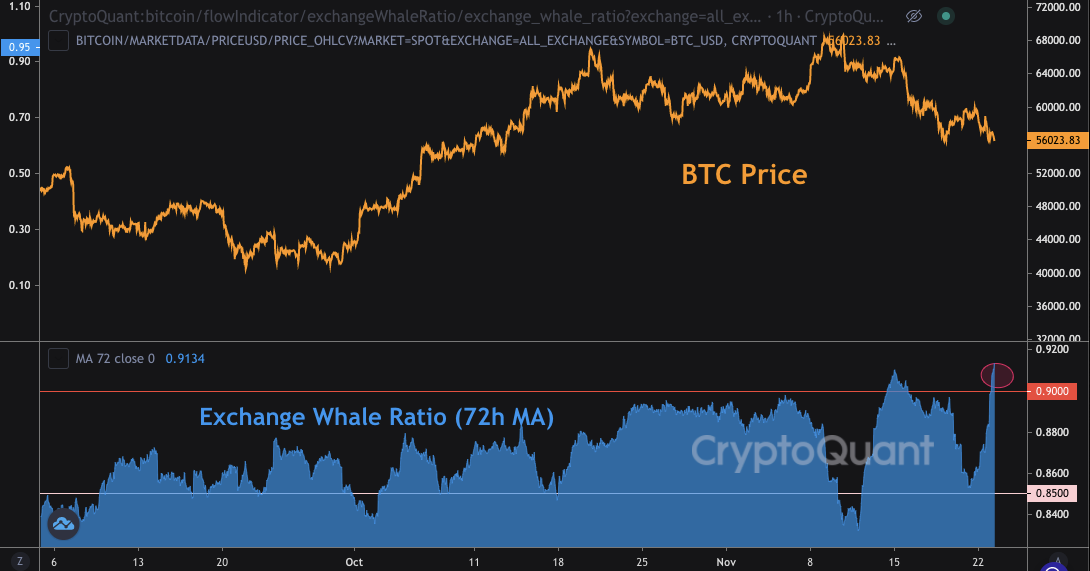

Data shows Bitcoin whales now account for 91% of the deposits going to exchanges, a trend that could be a bearish signal. Bitcoin Exchange Whale Ratio Surges To 91% As pointed out by a CryptoQuant post, the BTC all exchanges whale ratio has now risen to 91%, a historically bad sign for the crypto. The […]

On-chain data shows the Bitcoin whale exchange inflows have remained down after hitting a local peak a while back, a sign that could prove to be bullish for the price of the crypto. Bitcoin Whales Aren’t Sending Many Coins To Exchanges Right Now As pointed out by an analyst in a CryptoQuant post, the BTC inflows made a peak recently and have remained down since, a signal that the bottom may be in for the coin. The “all exchanges inflow” is an indicator that measures the total amount of Bitcoin being transferred to wallets of all centralized exchanges. When the value of....

On-chain data shows Bitcoin exchange inflows from whales holding between 1k to 10k BTC have spiked up recently, a sign that can be bearish for the price of the crypto. Bitcoin Exchange Inflows Spike Up Following Rally Above $24k As pointed out by a CryptoQuant post, the BTC whales with between 1k to 10k BTC seem to have sent a large stack to exchanges recently. The “exchange inflow” is an indicator that measures the total amount of Bitcoin being transferred to wallets of all centralized exchanges (both spot and derivatives). When the value of this metric spikes up, it means a....

Ethereum has seen the price of its native token ETH drop alongside Bitcoin as the bear market continues to gain group. This has triggered fear among investors, leading to high selling pressure on the digital asset. Even the Ethereum whales are now dancing to the tune of the bear market as they have begun to send large amounts of ETH to centralized exchanges. Ethereum Whales Push Toward Selling A recent Santiment report posted on the X (formerly Twitter) platform has shown that Ethereum whales may be looking to exit stage left at this time. The chart which was posted by the on-chain data....

On-chain data shows whale ratio has exceeded the 0.50 mark, historically a sign that whales are dumping in the short term. Bitcoin Whales Have Started Selling Their Coins As pointed out by a CryptoQuant post, the Bitcoin whale ratio has started going up above the 0.50 level. This signal has usually meant a bearish outlook for the crypto in the short term. The BTC all exchanges whale ratio is an indicator that gives an estimation of how many whales are sending their coins to exchanges. The metric does so by taking the sum of the top 10 transactions to each exchange and dividing it with the....