Bitcoin (BTC) Price Needs To Hold $18,000 At All Means, Why So?

Bitcoin (BTC) price has had turbulent times against tether (USDT) as more pain increases for bulls. Despite showing so much strength, the price of Bitcoin (BTC) bounced off from $19,000 in the past weeks to a region of $25,000 as many hoped for more relief to rally to a region of $30,000. The price of BTC faced rejection and has continued to fall with no sign of bears giving up. (Data from Binance) Related Reading: TA: Ethereum Price Nosedives, Why ETH Could Soon Test $1,200 Bitcoin (BTC) Price Analysis On The Weekly Chart BTC saw a decline in its price from $69,000 to around $18,500,....

Related News

Bitcoin price is trading inside a rising wedge formation, with bulls trying to push for more gains. RSI is on the move up, which means that buyers are in control of bitcoin price action at the moment. However, price is nearing the top of the wedge, which might hold as resistance and lead to a bounce back to the wedge support near $415. Also, RSI is near the overbought zone. Stochastic is in the overbought level already, signaling that buyers might need to take it easy from here and allow sellers to take over. If so, resistance around $418 could hold and lead to a test of support, which is....

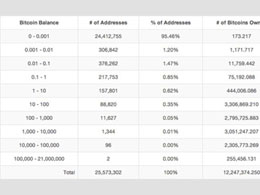

Here's a chart you may or may not find of interest (but we did, hence the post). A distribution of bitcoins by address, as compiled by BitcoinRichList.com. According to a chart, about 95.46 percent of in-use addresses hold 0.001 BTC or less (as of block 280,000). That means that if any of your bitcoin addresses hold between 0.01 and 0.1 BTC, you're in the 1 percent of the 'richest' bitcoin addresses. With higher balances come lower percentages, but it's interesting to see the distribution of the 12+ million bitcoins out in circulation at the moment. It's also important to remember that....

Bitcoin has seen a remarkable recovery trend that has caused its price to surge past $22,000 once more. This is a welcome development for the digital asset, which has been suffering from many dips, but it is not all rosy for the cryptocurrency. Since the market continues to remain in a bearish trend, there are levels that bitcoin must maintain above to keep such high prices. Otherwise, it risks falling more than 85% from its all-time high. Bitcoin Must Hold Above $17,000 Many prominent figures in the finance industry have shared their thoughts about where they see the price of bitcoin....

Ethereum has now lost its hold on an important level. This decline follows that of bitcoin which has now fallen below $20,000. However, for Ethereum, the fight continues to hold on to the one point where bulls still see some hope. However, with the way the market is moving, it may not be long before Ethereum is testing the critical $1,000 support level. Ethereum Falls Below $1,100 For Ethereum, holding above $1,100 for the past week had meant that there was still hope for a good run-up that could see it retest the $1,500 resistance. But this would only last just a little above $1,200....

Miners determine more of bitcoin price than most investors understand. The price at which miners are willing to sell usually correlates with how much profit that they can make from selling the coins that they have mined. Depending on the price of the asset, miners usually choose to sell or hold it. This could influence the market price of bitcoin. Related Reading | Number Of Short-Term Bitcoin Holders Hits All-Time Low, How This Affects The Price Profitability is the major reason for mining. But when profitability goes down, miners either sell and cut their losses, or the other....