Amid rising stablecoin inflow, cautious traders fear a dead cat bounce

Strong hands accumulated Bitcoin throughout last week’s historic correction but BTC’s inability to reclaim the $40,000 level has some traders afraid of a dead cat bounce. The recent extreme volatility in the cryptocurrency market following Bitcoin’s (BTC) dip to $30,000 and the recovery to $38,000 has traders confused about whether the current price action is a ‘dead cat bounce’ which will see token prices head lower or a solid reversal that will set the floor for the next leg higher for the market. While BTC price still remains more than 40% below its all-time high of $64,863, bulls have....

Related News

Bitcoin’s (BTC) latest upward move arrives at a time when confidence in the market remains uncertain, with many traders unsure whether the slight price recovery marks early strength or another temporary bounce. With last week’s pullback still fresh, a crypto analyst argues that most traders may label the recent recovery a dead cat bounce. However, he believes the narrative is misleading and predicts that Bitcoin’s rebound this week may be setting the stage for a stronger rally. Why The Bitcoin Price Recovery Is Not A Dead Cat Bounce Market analyst and founder of The House of Crypto, Peter....

Bitcoin has jumped more than 10% in the last 24 hours as the coin’s price reaches $47.5k. Past pattern may shed light on whether this is just a dead cat bounce or a lead up to a real move up. Bitcoin Netflows Of Past Dead Cat Bounces Compared As pointed out by a CryptoQuant post, a look at the BTC netflows of the past cycles may reveal the pattern that dead cat bounces have followed historically. The Bitcoin exchange “netflow” is an indicator that’s defined as the difference between the inflow and the outflow. When exchanges observe higher inflows compared to the....

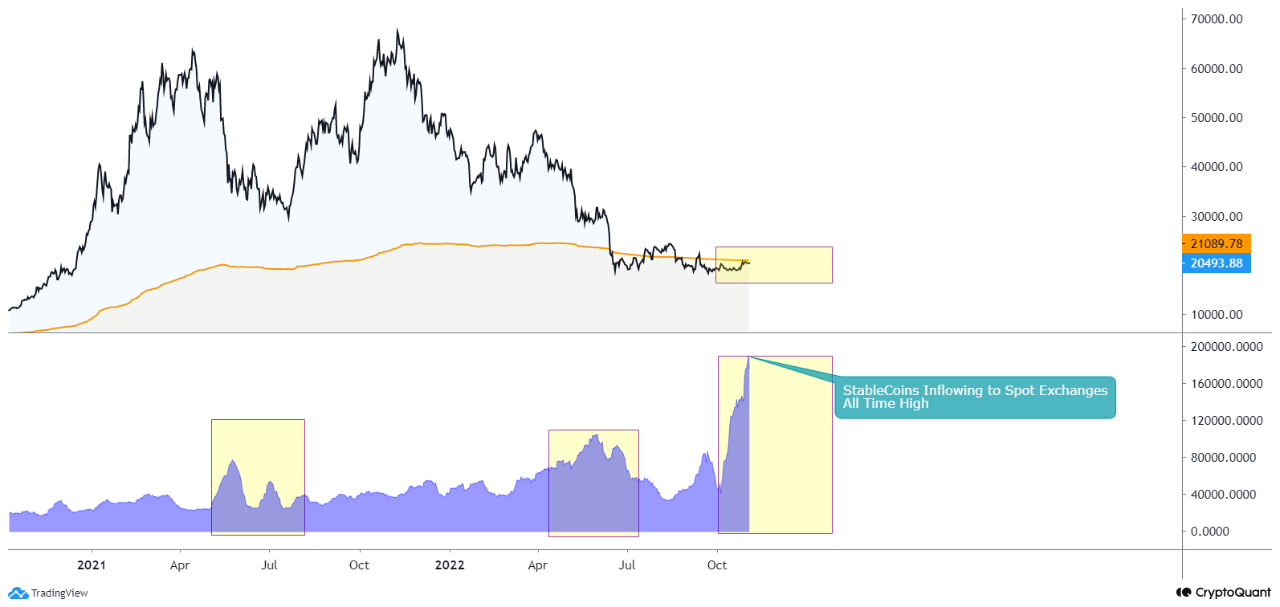

On-chain data shows the stablecoin exchange inflow mean has reached a new all-time high, here’s why this might prove to be bullish for Bitcoin. Stablecoin Exchange Inflow Mean Has Surged Up To A New ATH Recently As pointed out by an analyst in a CryptoQuant post, these inflows can be positive for Bitcoin in the long term, but might be bearish in the short term. The “stablecoin exchange inflow mean” is an indicator that measures the average amount of stablecoins per transaction going into the wallets of centralized exchanges. As stablecoins are relatively stable in value....

On-chain data shows a large amount of USDC inflows have just hit exchanges, a potential sign that investors are looking to buy the Bitcoin dip. USDC Exchange Inflow Has Registered Multiple Spikes Recently As explained by CryptoQuant community analyst Maartunn in a new post on X, the USDC Exchange Inflow has shot up recently. The “Exchange Inflow” here refers to an indicator that keeps track of the total amount of a given asset that’s being transferred to wallets connected with centralized exchanges. Related Reading: Bitcoin Mayer Multiple Retraces To Lower Bound—What....

Not saying that the US election results could impact an independent market like Bitcoin, one can still see digital currency traders mirroring stock market traders’ cautious take. Traders might want to take a break as the race for next presidential election gets tighter with each passing day. The world’s leading markets, namely S&P 500 (-2%), Dow Jones (-1.5%), Nasdaq Composite (-2.8%), have encountered a short burst of volatility, illustrating how speculators are giving too much weightage to pre-poll readings. These are, however, just cautious parameters amid uncertain....