A Deeper Look Into On-Chain Accumulation

Is bitcoin in a bear market? Let's take a deeper look at recent on-chain accumulation.The below is an excerpt from a recent edition of the Deep Dive, Bitcoin Magazine's premium markets newsletter. To be among the first to receive these insights and other on-chain bitcoin market analysis straight to your inbox, subscribe now.In the below edition of the Daily Dive we took a fresh look at the accumulation taking place using on-chain metrics and data.In last Friday’s Daily Dive, we examined the capital inflows that had seemingly come to a halt on the Bitcoin network, using realized market....

Related News

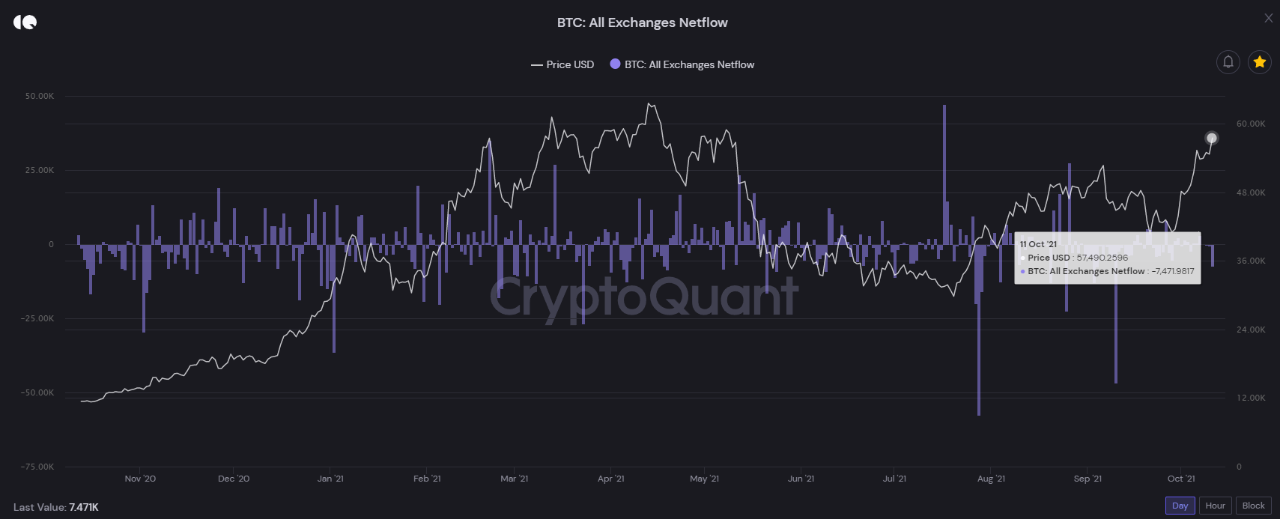

Bitcoin on-chain data suggests accumulation is going on as investors feel FOMO about the current rally above $57k. Bitcoin Accumulation Goes On As Investors Feel FOMO As explained by a CryptoQuant post, on-chain data is showing signs of accumulation as BTC netflows show negative spikes, and the stablecoins inflows indicate big moves. The Bitcoin netflow […]

On-chain data shows the Bitcoin “accumulation addresses” have observed all-time high inflows following the latest asset price slump. Bitcoin Accumulation Addresses Have Aggressively Bought The Dip As an analyst in a CryptoQuant Quicktake post pointed out, the total Bitcoin inflows going towards the accumulation addresses have set a new all-time high recently. The “accumulation addresses” […]

Willy Woo says Bitcoin could hit $200,000 in 2021 because long-time investors are more confident in the ongoing rally. According to on-chain analyst Willy Woo, the price of Bitcoin (BTC) could achieve a "conservative" target of $200,000 in 2021. The prediction revolves around the fact that long-time investors seem more confident in the recent rally.There are two key data points that suggest Bitcoin’s ongoing rally could explode higher. First, “HODLers,” or long-time BTC holders, aren't moving their funds for longer than in previous rallies. Second, BTC held on exchanges continues to....

Ethereum has gained a few percent since the lows of last week. The coin currently trades for $380 but peaked earlier today at $385. This price action has been underscored by reports that mass Ethereum accumulation has been taking place. Leading crypto analytics firm Santiment reports that ETH is leaving exchange wallets en-masse, suggesting accumulation and long-term confidence. The firm recently wrote: “ETH’s top 10 whale exchange addresses have continued swapping their funds to non-exchange […]

Latest data from Glassnode shows investors in the Bitcoin market have shown strong accumulation behavior recently. Bitcoin Holders Show Strong Accumulation For First Time In Months As per the latest weekly report from Glassnode, the BTC accumulation trend score has shown a value of more than 0.9 in the past couple of weeks. The “accumulation […]