This On-Chain Indicator Suggests Bitcoin Still Only 1/3rd Into Bear Market

The Bitcoin long-term holder SOPR may suggest that the crypto has still only gone one-third of the way through the latest bear market. Bitcoin 20-day SMA Long-Term Holder SOPR Has Only Been 86 Days Into Bottoming Zone As pointed out by an analyst in a CryptoQuant post, the crypto is still only 1/3rd of the way into the 260 days average historical bottoming period. The relevant indicator here is the “Spent Output Profit Ratio” (or SOPR in brief), which tells us about whether the average Bitcoin investor is selling at a profit or at a loss right now. The metric works by looking....

Related News

On-chain data shows the Bitcoin NUPL metric currently has values that would suggest the bear market is yet to hit in full swing, if the coin is in one. Bitcoin NUPL Value Still Not As Low As Previous Bear Markets As pointed out by an analyst in a CryptoQuant post, the BTC NUPL metric suggests market hasn’t neared a bear market bottom yet. The “net unrealized profile/loss” (or NUPL in short) is an indicator that tells us about the ratio of profit and loss in the Bitcoin market. The metric’s value is calculated by taking the difference between the market cap and the....

The price performance of Bitcoin has been underwhelming for most parts of 2025, failing to capitalize on the red-hot momentum in the last 30 days of 2024. Despite the market leader’s obvious struggles, investors have still not lost hope on BTC making one final rally to a new all-time high. However, the latest on-chain revelation […]

Bitcoin could soon see a bullish trend reversal as an on-chain indicator suggests it will do so. The on-chain indicator has predicted a number of notable price trends over the past few years. For one, during 2017’s bull market, the indicator formed a number of bounces off the 1.0 reading. Other fundamental trends also suggest that the prevailing Bitcoin trend is bullish. Bitcoin Could See a Bullish Trend Reversal Very Shortly: Key On-Chain Analysis Bitcoin […]

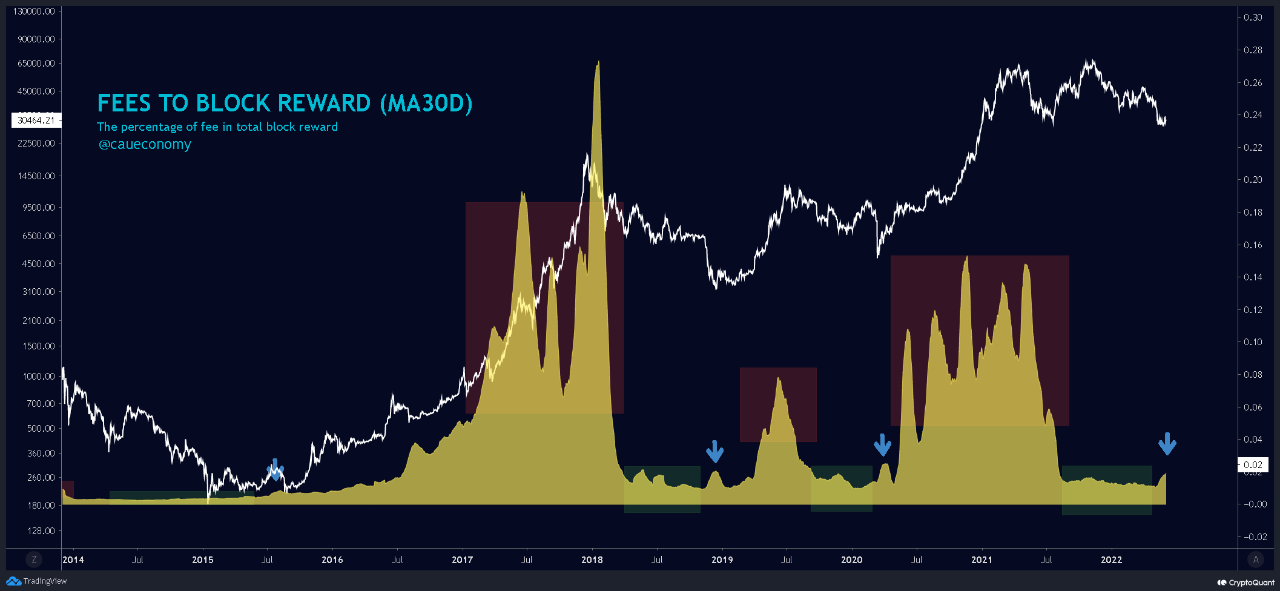

On-chain data shows recent trend in the Bitcoin transaction fees indicator may suggest that the crypto is now entering the late bear market stages. Bitcoin “Fees To Block Reward” Metric Has Gone Up Recently As pointed out by an analyst in a CryptoQuant post, the BTC fees metric may show that the bear market could […]

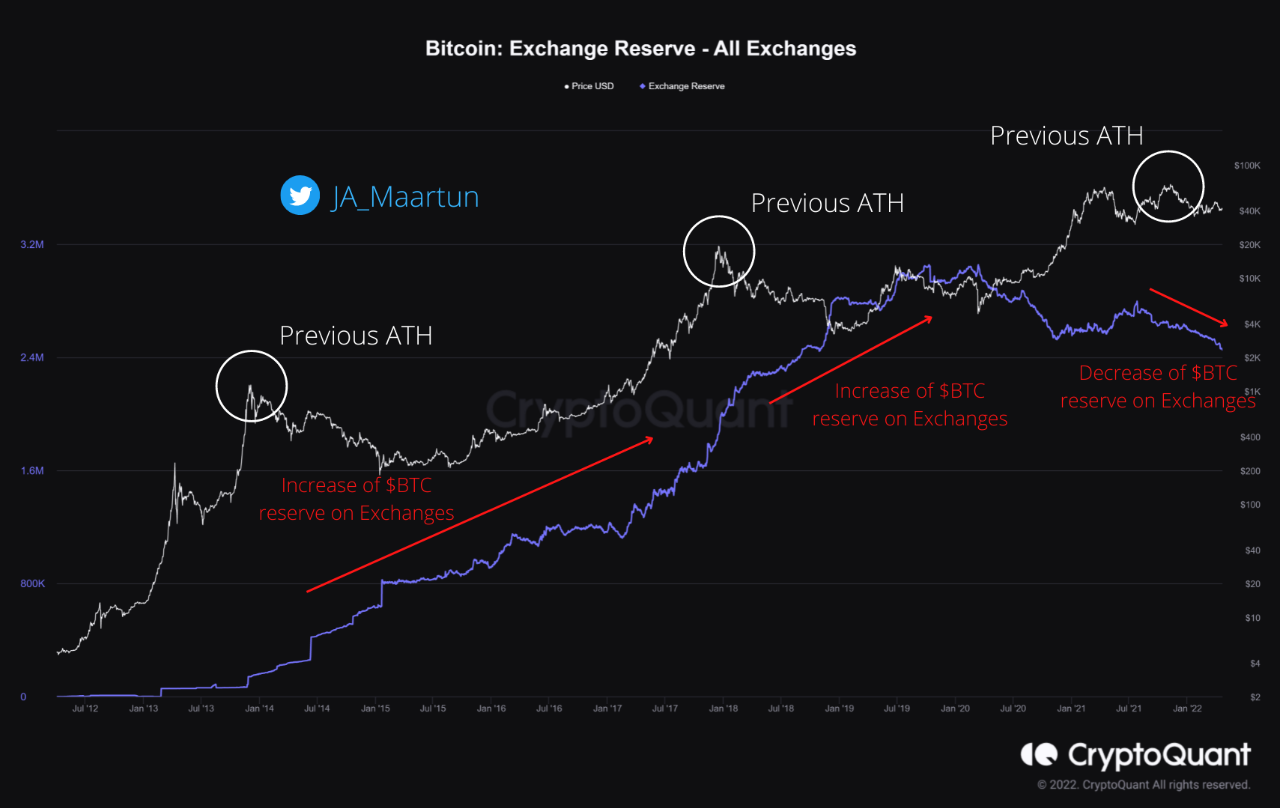

A quant has explained using on-chain data why the current Bitcoin bear market looks to be different from the previous ones. Quant Suggests This Bitcoin Bear Market Is Unlike The Rest As explained by an analyst in a CryptoQuant post, the exchange reserve continuing to trend down since the price all-time high isn’t typical of […]