Best Crypto To Buy As Bolivia’s Reserves Fall From $15B To $2B And Banks Embr...

What to Know: Bitcoin Hyper turns Bitcoin into a programmable, SVM-powered Layer 2, enabling low-latency BTC payments, DeFi, and gaming while anchoring security to Bitcoin. SUBBD leverages AI and Web3 to give creators lower fees, token-gated content, and crypto payouts, targeting the $85 billion content industry. Solana’s high throughput, low fees, and new US spot ETF support cement its role as a leading institutional-grade Layer‑1 blockchain. Bolivia’s reserve stress and banking pivot to digital assets underscore the growing demand for crypto infrastructure in the real world, rather than....

Related News

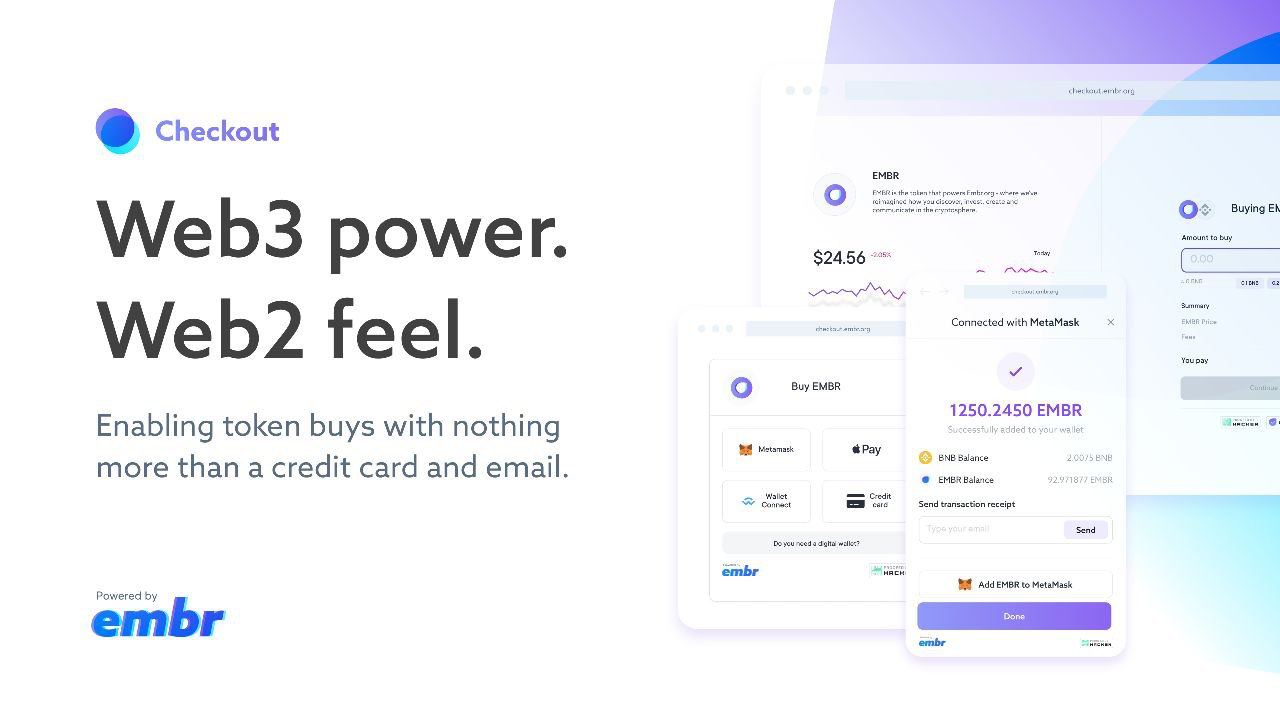

Embr is an all-remote corporation building a global Web3 fundraising infrastructure, and Checkout is the first of many product releases focused on moving startups and creators into a new era of the internet. Web3 has the potential to rewrite the future of economic opportunity for innovators and investors everywhere. Still, crypto first-timers and veterans alike often suffer through long, error-prone processes when purchasing digital assets. Embr Checkout eliminates all friction from the current state of token purchases, enabling people to buy tokens with nothing more than a credit card and....

The IMF warns that central banks may have to rethink what constitutes their reserve currency holdings. In a recent study, the global lender points to the changing geopolitical landscape, technological advances and the impact of the Covid-19 pandemic as events likely to influence the composition of reserves. Advances in Financial Technologies In addition to the US dollar, other currencies like the Euro, the Japanese and the British pound act as settlement currencies in global trade. Still, the US dollar dominates when it comes to its status as the world’s reserve currency. However,....

The U.S. Office of the Comptroller of the Currency (OCC) on Monday published a letter clarifying that national banks and federal savings associations can now hold reserves for stablecoin issuers in the country. According to the OCC’s interpretive letter, reserve accounts can either be funded through deposits from stablecoin issuers or deposits from individual stablecoin holders. It stressed that banks can hold such reserves provided that ”the issuer has sufficient assets backing the stablecoin in situations where there is a hosted wallet.” The letter responds to questions....

Federal banks in the U.S. see new capacity to provide services to crypto firms, specifically stablecoin operators. Per an interpretive letter from the U.S. Office of the Comptroller of the Currency released on Monday, national banks will be free to hold reserve currencies for stablecoins.The new guidance reads, "We conclude that a national bank may hold such stablecoin 'reserves' as a service to bank customers."Alongside the announcement, Acting Comptroller of the Currency Brian Brooks noted that stablecoin services are already a part of many banks' activities: “National banks and federal....

On-chain data shows the USDC exchange reserves have started to trend downwards recently, a sign that buyers may be exchanging the coin for Bitcoin and other cryptos. USDC Reserves On Exchanges Have Fallen Down Over The Past Few Days As pointed out by an analyst in a CryptoQuant post, investors may have started to exchange […]