Wen moon? Data shows pro traders becoming more bullish on Bitcoin price

MicroStrategy’s purchase of 7,002 BTC might have helped boost Bitcoin price today, but derivatives data also shows that pro traders are becoming more bullish. The $4,700 Bitcoin (BTC) price spike on Nov. 29 was likely a great relief for holders, but it seems premature to call the bottom according to derivative metrics. This should not come as a surprise because Bitcoin price is still 15% below the $69,000 all-time high set on Nov. 10. Just 15 days later, the cryptocurrency was testing the $53,500 support after an abrupt 22% correction.Today’s trend reversal was possibly encouraged by....

Related News

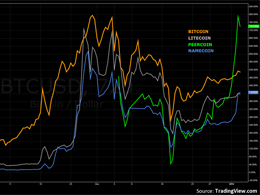

My working chart, showing Bitcoin price candles, grey volume bars, fractal highs(^) and lows(v), trendlines, support / resistance levels, Fibonacci retracement levels, MACD indicator and Moon Phases. I've discussed the use of all the indicators and line studies on my chart in previous articles, particularly this one. The only new addition this time is Moon Phases - note the two white full moons and two blue new moons in close proximity to price. Moon Phases show the extremes of the moon's waxing / waning cycle. I've included them as these lunar periods marked the last three significant....

Today is a rare full moon called the Super Flower Moon that also happens to coincide with a total lunar eclipse that gives the moon a crimson color. For the most part, this should have no impact on Bitcoin, however, after seeing a moon phase chart its impossible not to notice at least some correlation […]

Data shows funding rates for Bitcoin have turned positive, a signal that might indicate market sentiment is bullish among traders. Bitcoin Funding Rates Turn Positive, While Derivative And Spot Reserves Move Down As pointed out by a CryptoQuant post, the funding rates seem to be slightly positive for the BTC market right now. The Bitcoin funding rates are the payment that traders need to pay so that they can keep an open position. This additional, periodic fee is based on the difference between the perpetual contract market and the spot price. These funding rates are used for perpetual....

Retail traders turned their backs on EOS, but derivatives data shows pro traders maintaining a bullish perspective for the short-term. EOS rallied in May after Block.one, a blockchain software firm, announced a $10 billion funding round to build an EOS-based crypto exchange platform called Bullish. The EOSIO development company revealed that it had raised capital from Peter Thiel and Mike Novogratz, as well as hedge fund managers Alan Howard and Louis Bacon.In light of the 'bullish' news, the recent $6 local top stands 60% below the $15 high reached on May 12, and this leaves investors....

Data shows the Bitcoin Options 25 Delta Skew has seen a bullish flip, a sign that the traders may be expecting a price rebound. Bitcoin Options 25 Delta Skew Suggests Traders Are Positioning For Upside As pointed out by the analytics firm Glassnode in a new post on X, the Options 25 Delta Skew has […]