Two years since the Covid crash: 5 things to know in Bitcoin this week

It‘s been two years since BTC/USD crashed to $3,600 and it is trading over ten times higher — but clouds, as ever, are looming large. Bitcoin (BTC) starts a new week struggling to preserve support as key macro changes appear on the horizon.In what could turn out to be a crucial week for Bitcoin and altcoins’ relationship with traditional assets, the United States Federal Reserve is set to be the main talking point for hodlers.Amid an atmosphere of still rampant inflation, quantitative easing still ongoing and geopolitical turmoil focused on Europe, there is plenty of uncertainty in the....

Related News

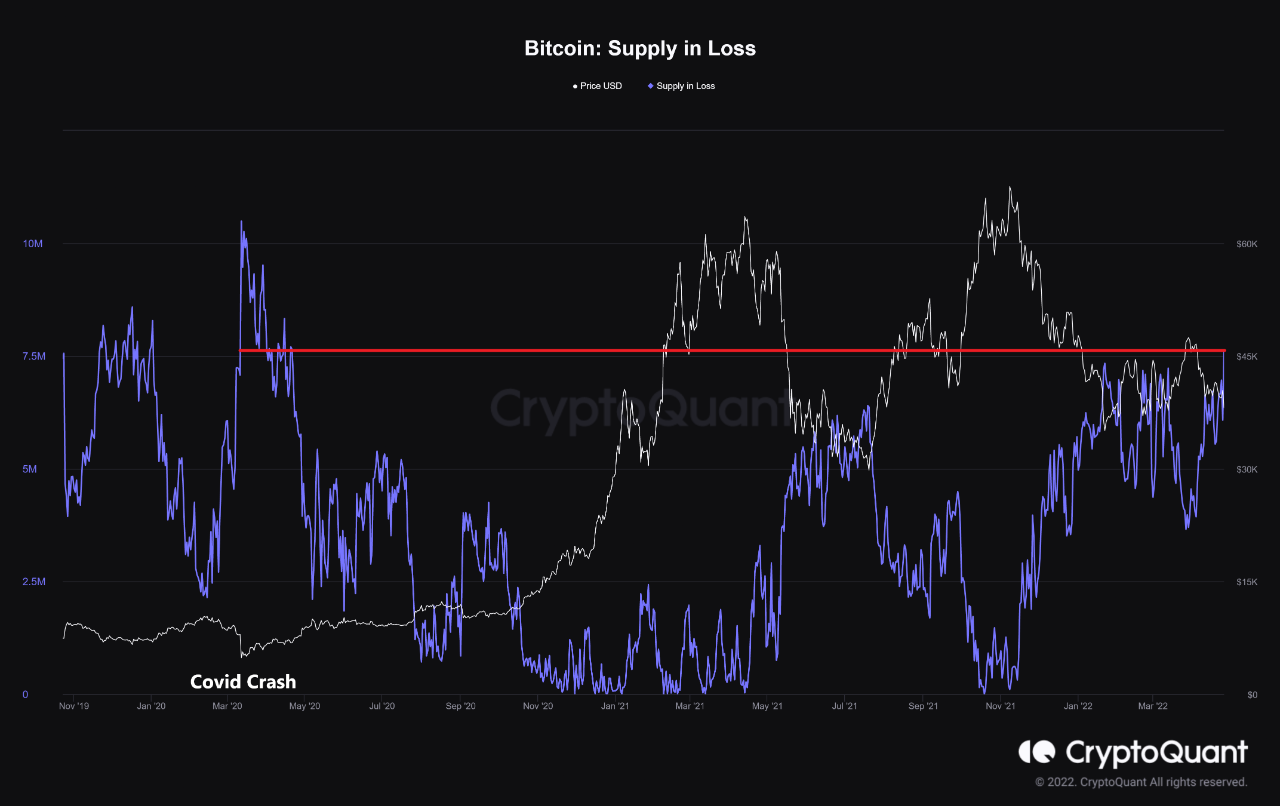

On-chain data shows the amount of Bitcoin supply in loss has now risen to the highest value since the COVID-19 crash. Bitcoin Supply In Loss Now Measures Around 7.6M BTC As pointed out by an analyst in a CryptoQuant post, the BTC supply in loss hasn’t shown such high values since the first half of […]

The market may witness flash crashes in the near term, and another March 12 drop is not completely off the map. It is no secret that March 12, 2020, marked one of the darkest days in crypto history. This was the day when Bitcoin (BTC) witnessed one of the largest single-day price dips in its decade-long existence, swooping from $8,000 to a staggering low of $3,600, albeit briefly, just for a matter of minutes. To put things into perspective, within a span of just 24 hours, over $1 billion worth of BTC longs were liquidated, causing one of the most intense value drops witnessed by the....

The housing market in the United States has been on the decline since late August. While unfortunate, it’s something Americans are used to. Since 2008, the country has struggled with the regular ups and downs of its housing market, and many of us, despite the media’s attempts to convince us that things “have gotten better,” remain skeptical. With the recent drop, that skepticism appears to be somewhat justified. In retrospect, though, how upset can one get about the current situation? As we have seen in the past when things go down, they eventually come back up. It’s bound to take time of....

Data shows the daily Bitcoin volatility has declined further this week, reaching very low levels not observed in around two years. Bitcoin 30-Day Volatility Has Come Down To Just 1.9% In Recent Days As per the latest weekly report from Arcane Research, the 7-day volatility made a low below the 1% mark earlier in the week. The “daily volatility” is an indicator that measures how the per day returns of Bitcoin have differed from the average during a specific period. While this period can be of any length, two versions of the metric are particularly natural, the 7-day volatility....

This past week was an exciting one, with the rising bitcoin price, community drama, and shaky financial markets giving us a lot of things to watch. China started the week with a massive stock market crash, putting the global economy on high alert. Meanwhile, in the Bitcoin community, we discovered that the Cryptsy team moved out of their building in Delray Beach, Florida without warning — no one knows where they are. The week started off on Monday, January 4, 2015, with the Bitcoin price following the $430s pattern established in the previous week. Nothing dramatic happened on the markets,....