Why A Gold Standard Won't Work In The Age Of Bitcoin

There’s no point in waiting around for an official gold standard to arise. People can start their own governments in a world of competing currencies. But if their governments are not some of the best and freest institutions that have ever existed, they will fall to the lonesome wayside, no doubt. They will be out of business.

As Trace Mayer points out, if Bitcoin enjoys the same success as Skype, then it will become a 8 billion dollar market cap in about six years. That means that each Bitcoin will be worth about $10,000. Unlike Skype, Bitcoin participants will get to taste that growth in the form of speculative appreciation. As Trace laments, Skype never paid him a dime for being one of their first 50,000 users.

The powerbase is naked when we use an alternative currency. Control is seriously gutted when exchange and currency becomes a float and market participants get to directly vote through product and service choice. Even if Bitcoin fails, it will have opened a scab upon the surface of force=based institutions everywhere. Copycats will flood as memes and real instruments throughout the world, and government control will continue its spin out of control.

From a philosophical perspective, any “standard” presumes the implementation of a singular system over space and time. By taking up residence in such a jurisdiction, one would then marry themselves to the standard of the place of their residence, even should they desire to refrain from partaking in the standard of the locale. By imposing a standard, such as a gold standard, the dominant authority precludes the rights of its inhabitants to choose their own lifestyle, thus precipitating the need for a system of punishment for those who deviate.

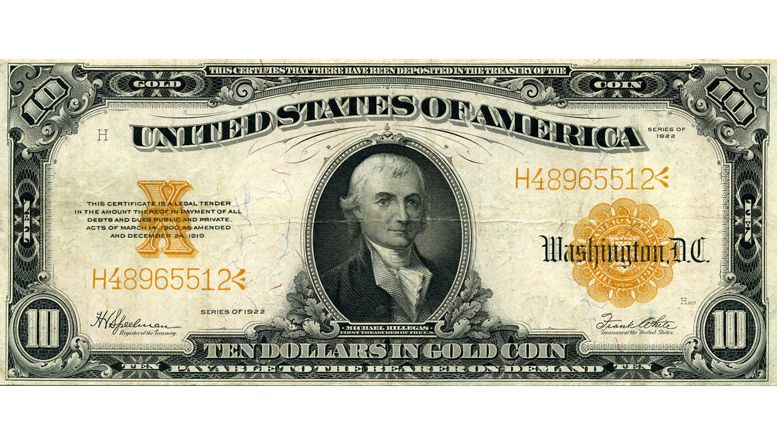

Based on current processes, some ruling authority, be it a federal government over its dominion, or a world authority, would have to set the terms of a gold standard, therefore making the transition to the gold standard a highly politicized and expensive affair. Nonetheless, gold has been estimated as representative of wealth through every record of history. Myriads of possessions over the course of civilization have been exchanged for two precious metals: gold and silver.

Sometimes, gold and silver has been taken in exchange by weight, in the shape of ornaments for the neck, the arms, the ears, or the ankles. Other times, they have been traded in the form of dust, bars or ingots that often have featured the mark of kings, governments or cities. The earliest such mark on an ingot may have been the image of a sheep or an ox, and the metal thus represented so much live stock.

Bitcoin is something entirely new, and judging by the success of other p2p technologies, it could be a force to be reckoned with on the global exchange scene.

Related News