Bitcoin Coin Days Destroyed Drops By 50% Amid Waning Price Action – What This...

As the new week begins, Bitcoin, the largest cryptocurrency asset, experienced a slight upward move after reclaiming the $111,000 price mark once again. Within the ongoing volatility that has hindered BTC’s uptrend, several key on-chain metrics are starting to exhibit bullish developments, suggesting a potential resurgence in the market. HODL Wave Intensifies As Bitcoin CDD […]

Related News

Bitcoin has sharply rebounded back to $20.4k, but is the decline actually over? This on-chain metric may suggest otherwise. Bitcoin Coin Days Destroyed Metric Has Spiked Up Over The Past Day As pointed out by an analyst in a CryptoQuant post, BTC Coin Days Destroyed is showing a spike at the moment. A “coin day” is the amount that 1 BTC accumulates after sitting still on the chain for 1 day. When any coin with some number of coin days shows any movement, its coin days reset back to zero, and are said to be “destroyed.” The “Coin Days Destroyed” (CDD)....

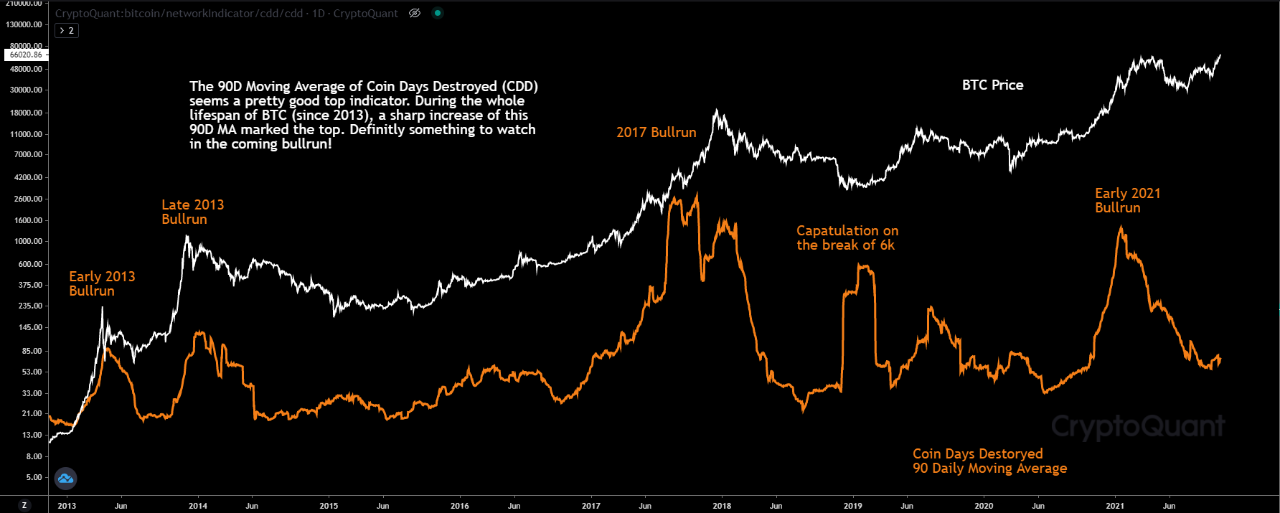

Historical data of the “coin days destroyed” indicator versus the Bitcoin price may suggest the metric can help predict tops. The Bitcoin Coin Days Destroyed (CDD) Indicator As explained by an analyst in a CryptoQuant post, the coin days destroyed metric might be a reliable indicator for BTC tops. A “coin day” is defined as […]

On-chain data suggests Bitcoin long-term holders have started to capitulate recently as the sharp price drop causes panic in the market. Bitcoin CDD Inflow Indicator Jumps Up, Showing Long-Term Holders Have Been Selling As pointed out by a CryptoQuant post, the recent price drop has pushed long-term holders towards selling their BTC. “Coin days” are the number of days a Bitcoin has remained dormant for. An example: if 1 BTC doesn’t move for 5 days, it accumulates 5 coin days. When such a coin would be transferred or moved, its coin days would be “destroyed” as....

With bitcoin price up around 70% over the last five weeks, Bitcoin's "coin days destroyed" metric isn't reacting as normal.

Data shows the Bitcoin 90-day Coin Days Destroyed metric has hit an all-time low, here’s what it says about investors in the BTC market. Bitcoin 90-Day CDD Has Recently Plunged To A New All-Time Low As per the latest weekly report from Glassnode, old BTC supply is more dormant right now than it has ever been during the history of the crypto. A “coin day” is defined as the amount accumulated by 1 BTC after sitting still for 1 day. The total coin days on the network, therefore, is a measure of how many days all the coins on the network combined have been stationary for, or....