Bitcoin Bearish Signal: Miner Deposits To Exchanges Spike

On-chain data shows that Bitcoin miner exchange inflows have shot up recently, something that could extend BTC’s price drawdown. Bitcoin Miner To Exchange Flow Metric Has Seen A Spike As pointed out by an analyst in a CryptoQuant Quicktake post, miners are upping their selling pressure. The on-chain indicator of relevance here is the “Miner […]

Related News

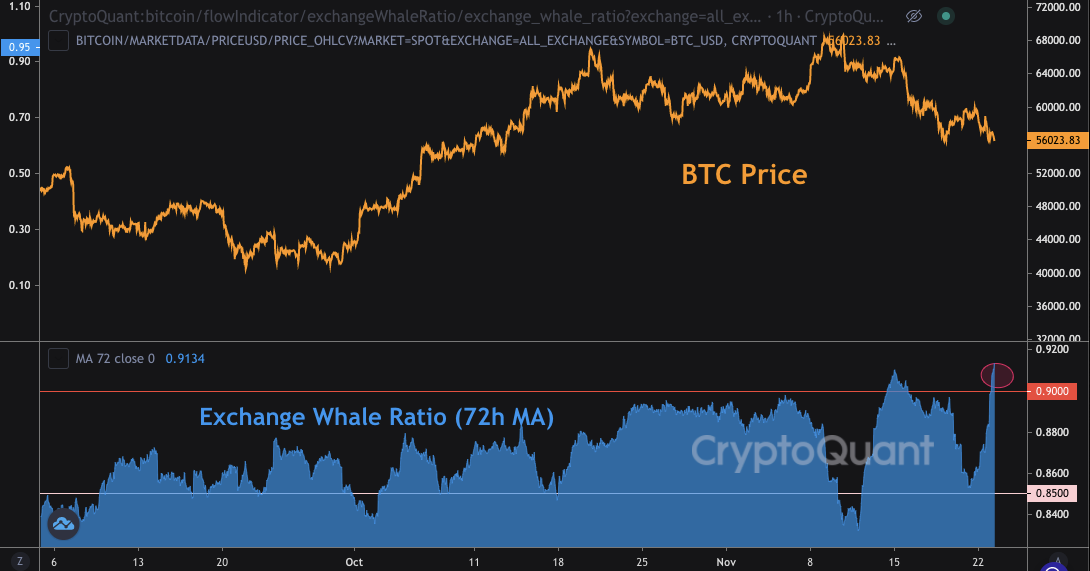

Data shows Bitcoin whales now account for 91% of the deposits going to exchanges, a trend that could be a bearish signal. Bitcoin Exchange Whale Ratio Surges To 91% As pointed out by a CryptoQuant post, the BTC all exchanges whale ratio has now risen to 91%, a historically bad sign for the crypto. The […]

On-chain data shows miners have sent a large amount of Bitcoin to spot exchanges recently, something that can be bearish for the value of the crypto. Bitcoin Miners To Spot Exchanges Flow Has Surged Up Over The Past Day As pointed out by an analyst in a CryptoQuant post, the latest spike in the miner exchange deposits is larger than any other recent peaks. The relevant indicator here is the “miners to spot exchanges flow mean,” which measures the total amount of Bitcoin being transferred by miners to spot exchanges. When the value of this metric shoots up, it means miners have....

On-chain data shows the Bitcoin exchange netflow has observed a sharp positive spike recently, a sign that could be bearish for the crypto’s price. Bitcoin All Exchanges Netflow Spikes Up Following 9% Inflation Report As pointed out by an analyst in a CryptoQuant post, exchanges have recently seen a large amount of BTC deposits. The “all exchanges netflow” is an indicator that measures the net amount of Bitcoin entering or exiting wallets of all centralized exchanges as a whole. The metric’s value is calculated by simply taking the difference between the inflows and....

On-chain data shows exchanges have received a huge Bitcoin inflow spike from long-term holders, a sign that could be bearish for the price of the crypto. Investors Holding Bitcoin Since 12 Months To 18 Months Ago Transfer A Huge Amount To Exchanges As pointed out by an analyst in a CryptoQuant post, some long-term investors holding on to their coins since between a year to a year and a half recently sent big inflows to exchanges. The relevant indicator here is the “exchange inflow,” which measures the total amount of Bitcoin moving to centralized exchange wallets. When the....

On-chain data shows Bitcoin exchange inflows from whales holding between 1k to 10k BTC have spiked up recently, a sign that can be bearish for the price of the crypto. Bitcoin Exchange Inflows Spike Up Following Rally Above $24k As pointed out by a CryptoQuant post, the BTC whales with between 1k to 10k BTC seem to have sent a large stack to exchanges recently. The “exchange inflow” is an indicator that measures the total amount of Bitcoin being transferred to wallets of all centralized exchanges (both spot and derivatives). When the value of this metric spikes up, it means a....