Bitcoin Bear Cycle Not Confirmed Unless $94K Is Lost – CryptoQuant CEO Explains

Bitcoin has dropped below the $100,000 mark for the first time since May, igniting renewed anxiety across the crypto market. The flagship cryptocurrency is currently trading near $97,000, with traders and investors facing growing uncertainty amid persistent selling pressure and waning momentum. Fear levels have surged as many market participants begin to question whether this […]

Related News

Bitcoin has long been characterized by its cycles of bull and bear markets, each marked by the trajectory of its price movements. However, the crypto appears to be in a transitional phase, according to a CryptoQuant analyst under the pseudonym CryptoHell. CryptoHell has recently shared insights into Bitcoin’s current market cycle, providing investors with key indicators to watch during this period. Related Reading: Is Bitcoin Heading For A Bear Market? Analysts Weigh In On The Price Struggles Understanding The Bitcoin Bull-Bear Transition Phase In a recent post on the CryptoQuant....

A quant has pointed out parallels between the current and the 2017 Bitcoin cycles, something that may contain hints about what’s next for the asset. The Current Bitcoin Cycle Has Shown Interesting Parallels With The 2017 Cycle As explained by an analyst in a CryptoQuant post, there have been five interesting recent events in the current cycle that are similar to what was seen in the 2017 cycle. The 2017 cycle hit its top in December of that year, while the current cycle hit its top back in November of 2021. The entirety of these cycles isn’t relevant in the context of the....

According to a CryptoQuant analyst, the Bitcoin price top isn’t in yet if the pattern of past bull cycles holds any weight. Bitcoin Might Reach A New ATH In This Cycle As per a CryptoQuant post, it’s possible that Bitcoin hasn’t yet reached the cycle top, and that a new all time high (ATH) might be achieved soon. There are two ways to define a cycle. The first is to make the initial point the BTC halving. Here is a chart that shows how the price of the coin moved in the 2012, 2016, and 2020 bull cycles based on this criterion: Price vs the number of days after halving in....

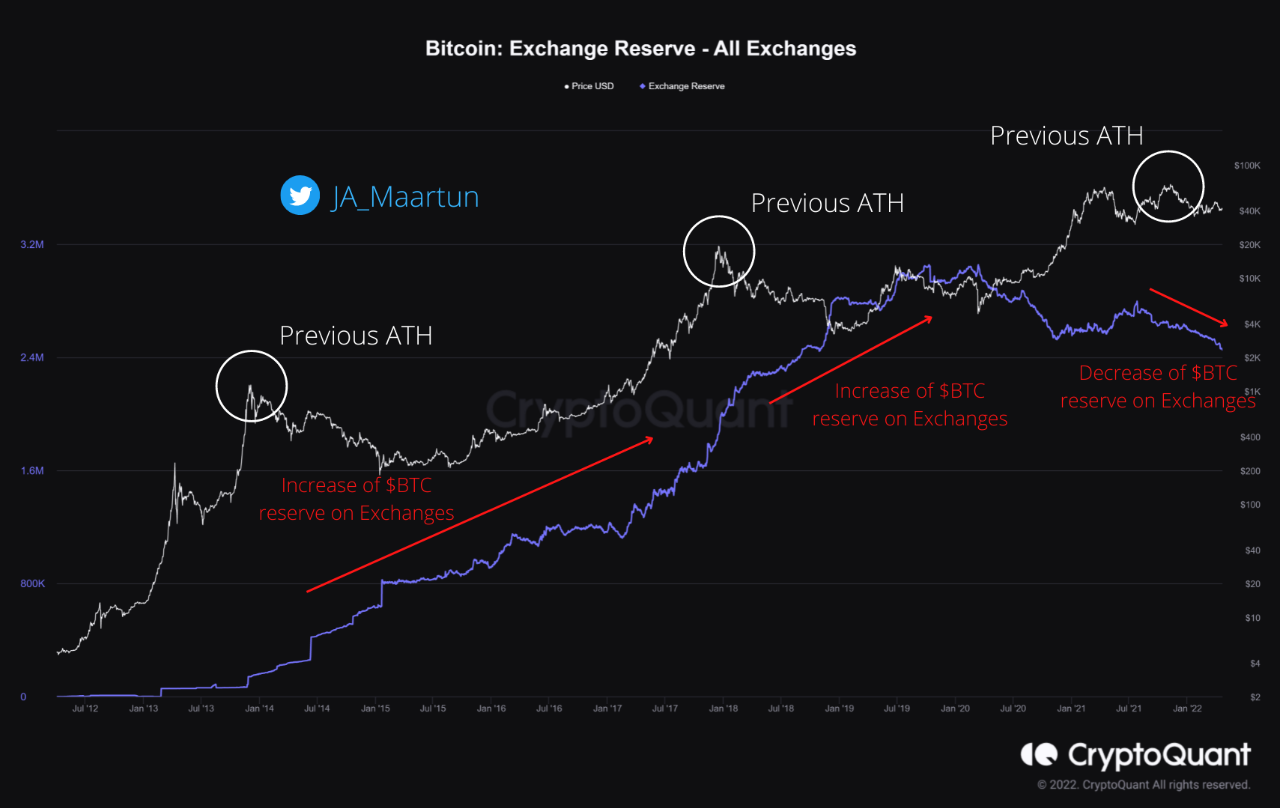

A quant has explained using on-chain data why the current Bitcoin bear market looks to be different from the previous ones. Quant Suggests This Bitcoin Bear Market Is Unlike The Rest As explained by an analyst in a CryptoQuant post, the exchange reserve continuing to trend down since the price all-time high isn’t typical of […]

The CEO at on-chain analytics firm CryptoQuant has declared the end of the Bitcoin bull cycle, but this analyst has provided a counterpoint. Realized Cap Could Provide Hints About What’s Next For Bitcoin In a post on X, CryptoQuant founder and CEO Ki Young Ju has explained why the bull cycle could be over for […]