GP Bullhound advises Bitcoin global technology leader KnCMiner on $15m Series B investment round

GP Bullhound, the international technology investment bank, acted as the exclusive financial advisor to KnCMiner on a $15m Series B investment led by Accel Partners with participation from existing investors including Creandum, GP Bullhound Sidecar and Martin Wattin.

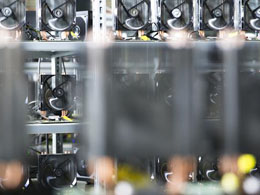

Founded in Stockholm in 2013 by datacentre and Application-Specific Integrated Circuit (ASIC) experts, KnCMiner started by designing and selling bitcoin mining hardware to 3rd party miners, but has been mining bitcoins directly on an industrial scale since February 2014. KnCMiner has generated over $100M in revenue since launch and re-invested most of its profits in the mining operation.

KnCMiner plans to use the new capital, in addition to cash generated through operations, to increase its bitcoin mining capacity and continue to build the bitcoin-processing infrastructure of the future. KnCMiner has also completed its 16nm chip tape-out with Alchip at Taiwan Semiconductor Manufacturing Co Ltd (TSMC) and expects to be first to market with this next generation chip technology.

Sam Cole, co-founder and CEO of KnCMiner, said:

“We have invested more than $70M over the last 12 months into building a world-class bitcoin mining operation and plan to invest a further $150M over the next 18 months as we become one of the key transaction processors within Bitcoin. We are delighted to be partnering with Accel in this next chapter, as we continue building our brand and relationships within the Bitcoin and broader financial communities.”

“The founders Sam and Marcus have managed in a short period of time to build a global leader in the blockchain/bitcoin ecosystem, one of the most dynamic and disruptive areas of the technology landscape. Their ambition, speed of execution and laser focus is bar none. As such, it is our utmost pleasure to act both as advisor and investor in KnCMiner”, commented Per Roman, Managing Partner of GP Bullhound.

This is GP Bullhound’s second transaction in 2015 and further highlights the firm’s commitment to working with category leaders in the Payments space.

GP Bullhound

As dealmakers in technology, GP Bullhound provides independent strategic advice on mergers and acquisitions and private placements to entrepreneurs, companies and investors. By combining a true passion for innovation with great access to global buyers and capital across Europe, US and Asia, GP Bullhound has completed transactions with many category leaders including Avito, Delivery Hero, Fjord, King.com, Pingdom, Pozitron and Spotify. The firm was founded in London in 1999 and today also has offices in San Francisco, Stockholm, Berlin and Manchester.

For more information about GP Bullhound please visit http://www.gpbullhound.com/

KnCMiner

Founded in 2013, KnCMiner is a global Technology leader in the Bitcoin space. KnCMiner has an exceptional track record of delivering next generation ASIC chips to the market. Based in Sweden, KnCMiner develops state-of-the-art chip design and cloud services for blockchain-based applications and crypto currency mining. KnCMiner also runs industrial-scale operations in other locations globally with the main focus in the Arctic Circle.

For more information, visit the KnC website at http://www.kncminer.com/

Related News