Altcoins Selling Pressure Persists As Exchange Inflow Hits 2025 High — Details

Altcoins have not quite recovered from the significant downturn that hit the financial markets a week ago. Most large-cap cryptocurrency assets, including Bitcoin, are either revisiting their low from the previous week or struggling to mount any real pressure from their current position. For instance, the largest altcoin by market cap, Ethereum, after briefly returning to above $4,200 earlier this week, is back to its level in the aftermath of the October 10th bloodbath. According to the latest on-chain data, it appears that investors are increasingly losing confidence in the long-term....

Related News

The price performance of Bitcoin over the past two weeks has been a major source of concern, as the coin’s value continues to drift away (about 15% down now) from its all-time high. As the flagship cryptocurrency slows down, the latest on-chain data suggests that a group of investors is exiting the market en masse. More Short-Term Holders Are Giving Up Their Holdings In an October 18 post on the X platform, on-chain analyst Darkfost revealed that a significant number of Bitcoin’s short-term investors have started to close their positions and realize their losses. Related....

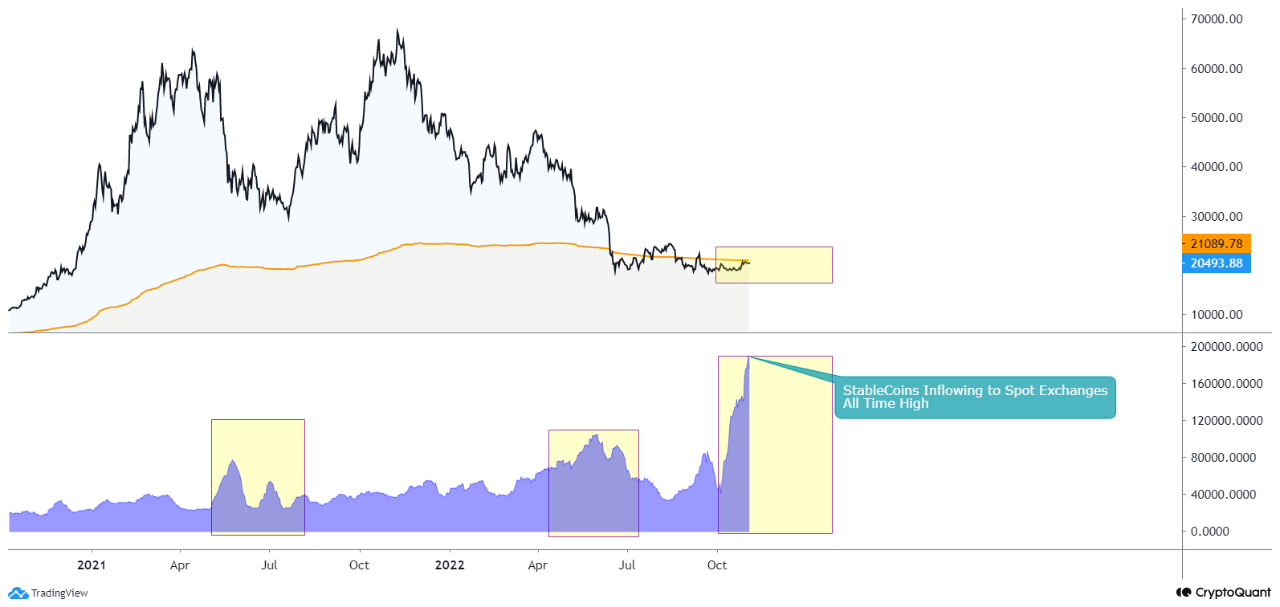

On-chain data shows the stablecoin exchange inflow mean has reached a new all-time high, here’s why this might prove to be bullish for Bitcoin. Stablecoin Exchange Inflow Mean Has Surged Up To A New ATH Recently As pointed out by an analyst in a CryptoQuant post, these inflows can be positive for Bitcoin in the long term, but might be bearish in the short term. The “stablecoin exchange inflow mean” is an indicator that measures the average amount of stablecoins per transaction going into the wallets of centralized exchanges. As stablecoins are relatively stable in value....

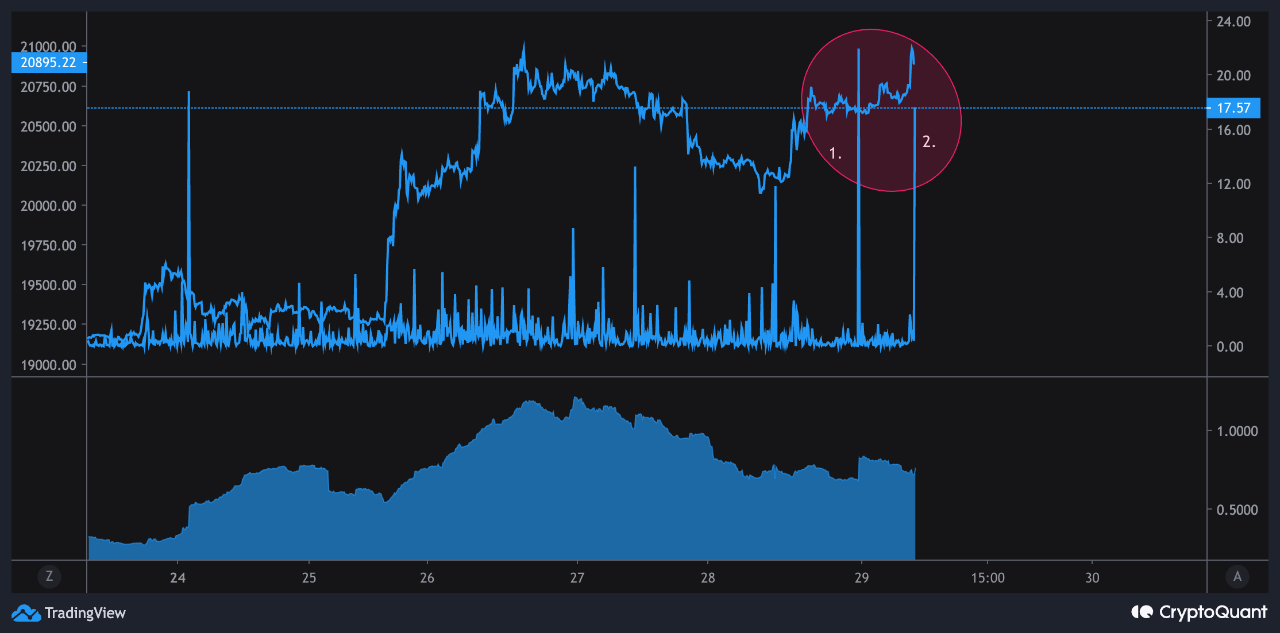

On-chain data shows the Bitcoin exchange inflows have spiked up over the last day, something that could prove to be bearish for the price of the crypto. Bitcoin Exchange Inflow Mean Has Observed Two Spikes In The Past 24 Hours As pointed out by an analyst in a CryptoQuant post, the two exchange inflow mean spikes amounted to around 21 BTC and 17 BTC respectively. The “exchange inflow mean” is an indicator that measures the mean amount of Bitcoin being transferred to the wallets of centralized exchanges per transaction. It’s different from the normal inflow metric in that....

On-chain data shows Bitcoin netflows are still deeply negative, a sign that means BTC remains bullish. This is despite the dip to $44k. Exchanges Observe Deeply Negative Bitcoin Netflow As per a CryptoQuant post, the Bitcoin netflow indicator has been deeply negative recently, suggesting that signs are still overall bullish for the market. Related to the netflow are two other indicators, the outflow and the inflow. The first one is defined as the total amount of BTC flowing out of exchanges towards personal wallets. Related Reading | Hot Bitcoin Summer. But Why Altcoins Are On The....

On-chain data shows that shortly after crypto exchange Binance observed Bitcoin inflow of around 12k BTC, price fell by almost 5%. Huge Bitcoin Inflow To Binance As pointed out by a CryptoQuant post, inflow of around 12k BTC was seen on Binance, the largest crypto exchange by market volume. The Bitcoin inflow is an indicator that shows the total amount of BTC transferred to a crypto exchange from a personal wallet. As investors usually send their crypto to exchange wallets for cashing out, altcoin purchasing, etc., the indicator’s value going up would imply there is some selling....