Bitcoin Supply In Loss Turns Up: A Potential Bear Market Signal

Bitcoin is trying to reclaim the $90,000 level as the market remains trapped in a phase of uncertainty and consolidation. After months of elevated volatility, price action has narrowed, reflecting hesitation from both buyers and sellers. This indecision has fueled a growing divide among analysts. Some argue that Bitcoin is merely digesting prior gains, while […]

Related News

The cryptocurrency market has weathered a challenging period, testing the resolve of the most seasoned investors. After a prolonged period of downward pressure, the Bitcoin Supply-Loss Chart is flashing a possible bottom signal. A Deeper Look At Bitcoin Supply In Loss Chart Bitcoin on-chain data on the loss chart is currently flashing a possible bottom. In an X post, CryptosRus has revealed that the supply in the Loss metric chart tracks the total amount of BTC held by addresses where the current market price is below the average cost basis of those holdings. Essentially, the portion of....

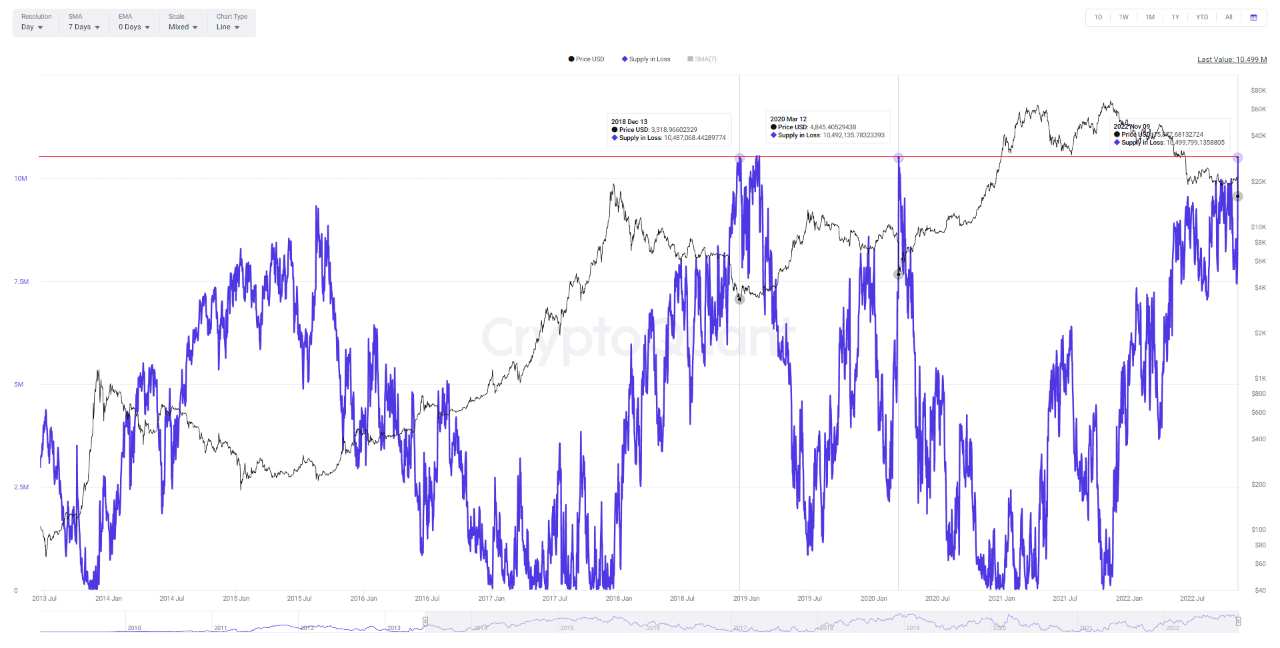

On-chain data shows the amount of Bitcoin supply in loss has now reached levels similar to during the COVID crash and the 2018 bear market bottom. Bitcoin Supply In Loss Spikes Up Following The Latest Crash As pointed out by an analyst in a CryptoQuant post, the BTC supply in loss has set a new record for this year following the FTX disaster. The “supply in loss” is an indicator that measures the total amount of Bitcoin that’s currently being held at some loss. This metric works by looking at the on-chain history of each coin in the circulating supply to see what price it....

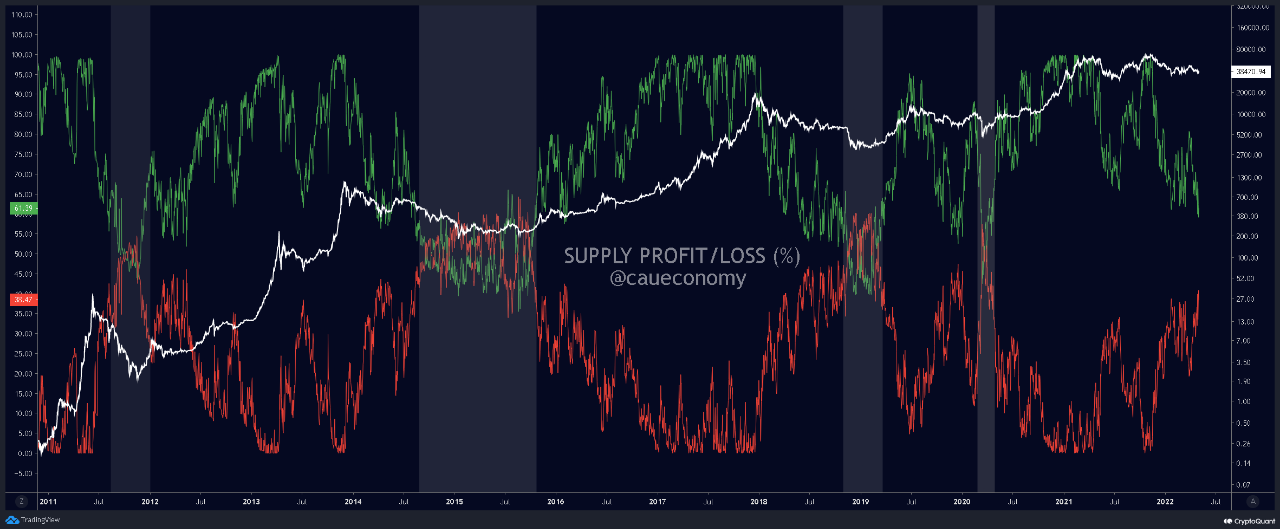

Crypto research firm CryptoQuant has flagged a potentially troubling development for Bitcoin (BTC) and the wider digital asset market, pointing to an early warning signal that has historically appeared ahead of prolonged downturns. In a report released Wednesday, the firm noted that Bitcoin’s supply in loss metric has begun to rise again, a shift that has often marked the early stages of past bear markets. Possible Shift Toward Bear Market Structure According to analysis by CryptoQuant contributor Woominkyu, increases in supply held at a loss tend to signal that market weakness is....

On-chain data shows Bitcoin hasn’t yet hit a bear market bottom as the supply in profit is still more than that in loss. Bitcoin Supply In Profit/Loss Says A Majority Of Network Is Still In Profit As explained by an analyst in a CryptoQuant post, past trend may suggest that the current BTC market still […]

Bitcoin slipped below the $80,000 level over the weekend as selling pressure intensified across global markets. Reinforcing a climate of uncertainty that has weighed heavily on risk assets in recent weeks. The move came amid broad weakness in equities, elevated volatility, and declining liquidity conditions, pushing many investors into a defensive posture. While the price action alone may resemble prior corrective phases, on-chain data suggest that the underlying market structure is beginning to change. A recent analysis from CryptoQuant indicates that Bitcoin is starting to exhibit....